From his vantage point in Lausanne, Switzerland, Boston Scientific’s Angelo De Rosa is witnessing a surge of interest in the company’s Farapulse pulsed field ablation (PFA) system among physicians who treat patients with atrial fibrillation (AFib), a rapid heart rhythm that is one of the most common cardiac conditions.

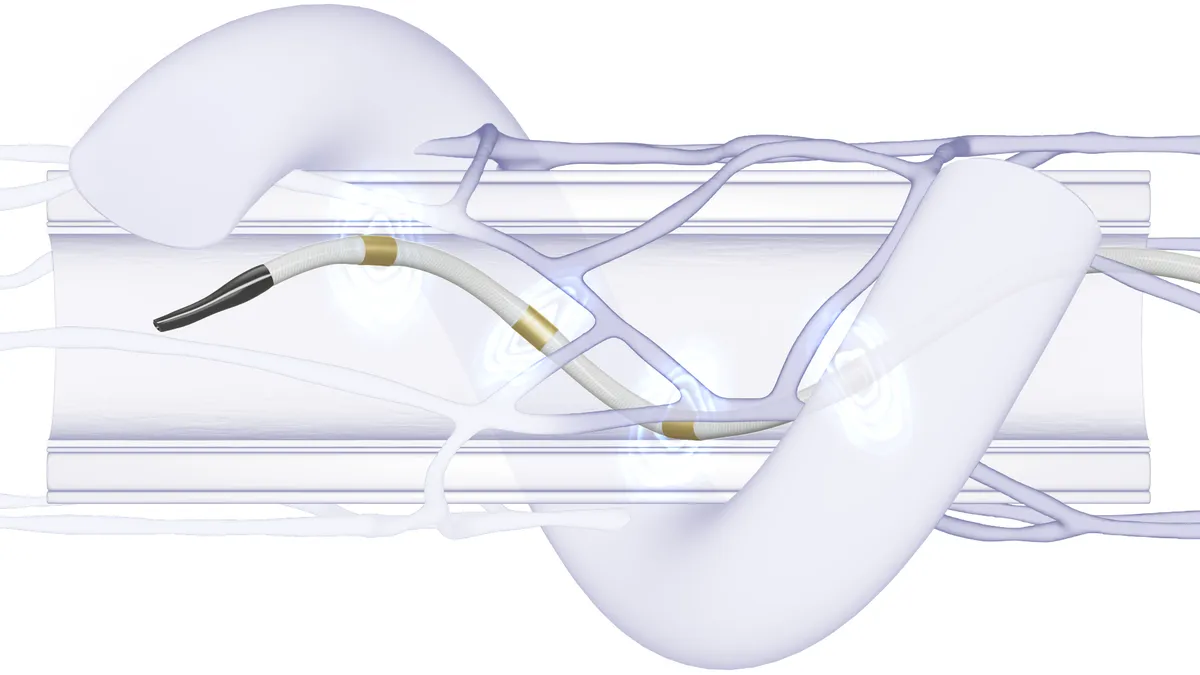

Current cardiac ablation devices use either heat (radiofrequency energy) or extreme cold (cryoablation) to create small scars to block AFib’s irregular heartbeats. Pulsed field ablation is a nonthermal technique that uses short high-voltage pulses to disrupt cell membranes. Data showing it to be a safer, faster and more precise approach for treating AFib is generating enthusiasm for the emerging PFA market.

Boston Scientific, through its 2021 acquisition of privately held Farapulse, was the first of the big cardiac device makers to offer a PFA system in Europe. Medtronic became the second, after gaining the CE mark in March for its Affera platform. PFA devices are not yet approved in the U.S., but Medtronic, Boston Scientific and Johnson & Johnson all have clinical trials underway.

Last week, Boston Scientific said strong adoption of Farapulse helped generate first-quarter growth of 57% year-over-year in its electrophysiology business in Europe, the Middle East and Africa. MedTech Dive talked with De Rosa, Boston Scientific’s vice president of rhythm management for the EMEA region, about what is driving acceptance of PFA technology.

This interview has been edited for length and clarity.

MEDTECH DIVE: How has Farapulse been received since its market launch in Europe?

DE ROSA: We are learning more and more every day on how this market will evolve. Pulsed field ablation energy sources bring a new, revitalized energy into the electrophysiology field. We believe that the success and the opportunity with pulsed field ablation, and in particular Farapulse, with the data we have now – over 10,000 patients – have shown the potential of really being a game changer, and will redefine the landscape of the ablation market.

Will pulsed field ablation replace cryoablation or radiofrequency (RF) ablation as the preferred treatment for atrial fibrillation?

Boston Scientific has been the first company to offer all three primary treatment modalities for the ablation of atrial arrhythmias: RF, cryo, and pulsed field ablation.

And what we are observing is that physicians who are using Farapulse today are coming from both sources. From a procedural standpoint, it is probably more straightforward for cryoablation users, because the technique is similar to cryo. They are jumping very fast on this new solution, and of course they strongly appreciate that it's safe, reproducible, efficient and with a short learning curve. Safety is the No. 1 benefit that Farapulse brings to patients, and this is of course a strong advantage no matter if you are a cryo or RF user, and the duration of the procedures is extremely consistent.

We will still see the three modalities remaining in the market for quite some time. But in the long term, three to five years from now, I believe cryoablation will be heavily resized. Pulsed field ablation will become the first choice, and some more complex cases will stay with radiofrequency. That’s [it] in a nutshell. We clearly expect a massive shift toward pulsed field ablation in the coming years.

What differentiates Farapulse from the competition?

While the energy source is the same, there are a lot of variables within the energy source that will make the type of solution successful or not. In RF you deliver RF in the same way; in cryo you deliver cryo in the same way. For PFA, because it's a high voltage train of pulses, you can deliver those in many different ways. There is a biphasic waveform, there is bipolar versus monopolar, and basically the combination of the generator with the catheter makes a big difference in how, in the end, the energy is delivered to the heart. The first thing to keep in mind is you can only compare PFA by looking at clinical outcomes.

Our solution, Farapulse, was the first approach designed for pulmonary vein isolation. In addition, the Advantage IDE [investigational device exemption] trial – our prospective, single arm, multi-center, global IDE study – will investigate in a persistent AF population.

Today, we see more and more hospitals, when they approach de novo patients with atrial fibrillation, the first step is always PV isolation – the isolation of the pulmonary veins. The Farapulse system has been specifically designed for that type of procedure. The geometrical structure has been clearly designed for that purpose. Other systems have been designed with the idea of having one side being more versatile, so being used for a different type of ablation, but on the other end, not exactly specific for PV isolation. So, in a way they are very limited when it comes to PV isolation, which is the most common type of ablation that hospitals do.

There's a big debate in the market [on] if you need to use a mapping system. We are currently working to integrate Farapulse with the Rhythmia HDx Mapping System, a three-dimensional mapping system to understand which part of the heart you are in. The difference is our [PFA] system works either standalone, or we are working, for the future, on integration with our mapping system.

And this is one of our numerous fundamental competitive differences, offering wider procedural options, which is a considerable advantage compared to other systems from competition. It makes our system ultimately more flexible for hospital usage.

What has your clinical data indicated about the effectiveness of PFA?

Not all PFA is the same, and Farapulse has by far the most robust clinical data in the PFA market. We showed in the range of 96% lesion durability at one year, and that is excellent lesion durability, which is really the key. Very recently, at EHRA [European Heart Rhythm Association], Dr. Vivek Reddy, [director of cardiac arrhythmia services at Mount Sinai Hospital], presented the Manifest PF real world data. With more than 1,500 patients, one-year freedom from atrial fibrillation was 82% in patients with paroxysmal [AFib] and 72% in patients with persistent [AFib], which are among the best efficacy results for atrial fibrillation ablation ever reported in a registry this large. Those data are unique to Farapulse, as not all PFA is equal.

What is the status of Boston Scientific’s Advent clinical trial in the U.S., and when does the company expect Farapulse to become available in the U.S. market?

We have completed our enrollment. We are in the follow-up phase, and we expect results of Advent [a double-blind, randomized trial against conventional thermal ablation] to be published right after the summer. So it's coming very quickly. And then after that, we need traditional time to get FDA approval, but publicly we have disclosed that we expect FDA approval in the U.S. next year.