M&A

-

Illumina to buy SomaLogic for up to $425M

Illumina said adding SomaLogic would support the company’s multiomics strategy and strengthen the value of its NovaSeq X products.

By Susan Kelly • June 23, 2025 -

Rise in VC activity tees up ‘strong year’ for medtech funding: PitchBook

Improvements in VC funding contrasted with M&A activity, which has fallen short of the level PitchBook predicted under the Trump administration.

By Nick Paul Taylor • June 20, 2025 -

Anne Wojcicki wins bid to buy back 23andMe for $305M

A nonprofit led by the co-founder and former CEO of 23andMe outbid competitors for nearly all of the company’s assets.

By Elise Reuter • June 17, 2025 -

Owens & Minor spikes $1.36B Rotech buyout over regulatory barriers

The companies scrapped the merger because securing FTC clearance “proved unviable in terms of time, expense and opportunity.”

By Nick Paul Taylor • June 6, 2025 -

Why Medtronic plans to spin out its diabetes business

While some analysts questioned why Medtronic would leave a fast-growing market, others backed the company’s plan to focus on segments with higher margins.

By Elise Reuter • May 22, 2025 -

Merit buys hemostatic device maker Biolife for $120M

Merit CEO Fred Lampropoulos said Biolife’s StatSeal and WoundSeal devices “address an estimated $350 million global market opportunity.”

By Nick Paul Taylor • May 21, 2025 -

Regeneron wins bid to buy 23andMe out of bankruptcy

The biotech, which has for years invested in genetics research, plans to acquire "substantially all" of testing firm 23andMe's assets for $256 million.

By Ned Pagliarulo • May 19, 2025 -

Masimo finds buyer for consumer audio business

In addition to offloading the Sound United segment for $350 million, the company lowered its 2025 profit forecast to account for tariffs.

By Susan Kelly • May 7, 2025 -

News roundup

Intuitive wins new FDA nod for single port robot; Resmed buys diagnostic facility

Intuitive secured a single port robot clearance, Resmed bought sleep testing facility Virtuox, and Precision Neuroscience hired an executive to support its BCI commercialization plans.

By Nick Paul Taylor • May 2, 2025 -

Illinois, Minnesota join FTC challenge against $627M Surmodics buyout

The Illinois attorney general said the deal represents a “troubling trend of wealthy investors attempting to limit competition and innovation.”

By Nick Paul Taylor • April 18, 2025 -

Kandu Health merges with BCI company Neurolutions

The merger brings together Neurolutions’ brain computer interface technology and Kandu Health’s telehealth services to try to improve stroke care.

By Nick Paul Taylor • April 9, 2025 -

Eargo, Hearx merge into one OTC hearing aid firm, receive $100M boost

Hearx, the maker of Lexie hearing aids, and Eargo competed for the OTC hearing aid market created by the FDA in 2022.

By Nick Paul Taylor • April 3, 2025 -

Hospital-at-home companies DispatchHealth, Medically Home to merge

DispatchHealth CEO Jennifer Webster will lead the combined company once the deal closes, which is expected in mid-2025.

By Emily Olsen • March 21, 2025 -

Labcorp to buy Opko unit’s cancer test assets for up to $225M

Labcorp will acquire BioReference Health's oncology diagnostics operations as the lab company works to expand in high-growth testing areas.

By Susan Kelly • March 12, 2025 -

FTC challenges $627M private equity takeover of Surmodics

The regulator said the buyout “would lead to a highly concentrated market for outsourced hydrophilic coatings and eliminate significant head-to-head competition.”

By Nick Paul Taylor • March 7, 2025 -

Trump administration policies could create headwinds across healthcare: Fitch

The credit ratings agency is most concerned about Medicaid cuts and how government layoffs will affect device approvals.

By Susanna Vogel • March 5, 2025 -

Boston Scientific to buy Sonivie for up to $540M

Boston Scientific looks to catch up with Medtronic and Recor Medical in the much-hyped renal denervation space with its Sonivie acquisition.

By Ricky Zipp • March 3, 2025 -

Teleflex to split in 2, buy Biotronik assets for $791M among slew of actions

Teleflex, whose shares sank nearly 20% Thursday, will acquire most of Biotronik’s vascular intervention assets. Teleflex also announced a CFO transition.

By Susan Kelly • Feb. 27, 2025 -

Thermo Fisher to buy Solventum’s purification and filtration unit for $4.1B

Wall Street applauded the deal, sending shares of Solventum, the 3M spinoff, up 10% on Tuesday.

By Susan Kelly • Feb. 25, 2025 -

Quest to buy Fresenius Medical Care kidney testing assets

The acquisition will add dialysis-related water testing to Quest’s portfolio and position the company to perform the tests and other end-stage kidney disease services for Fresenius Medical Care.

By Nick Paul Taylor • Feb. 25, 2025 -

FTC retains stricter merger guidelines under Trump

FTC Chair Andrew Ferguson sent a memo to agency staff on Tuesday clarifying that the Biden-era guidelines will remain in place — for now.

By Rebecca Pifer • Feb. 20, 2025 -

Medtronic buys Nanovis’ nano technology for use in spine implants

Medtronic will use the technology to develop PEEK interbody spine fusion devices that enhance implant fixation.

By Nick Paul Taylor • Feb. 13, 2025 -

M&A and a separation take center stage in latest earnings season

BD announced it would split from its biosciences and diagnostics unit, while Zimmer Biomet updated investors on its $1.1 billion buy of Paragon 28.

By Susan Kelly • Feb. 10, 2025 -

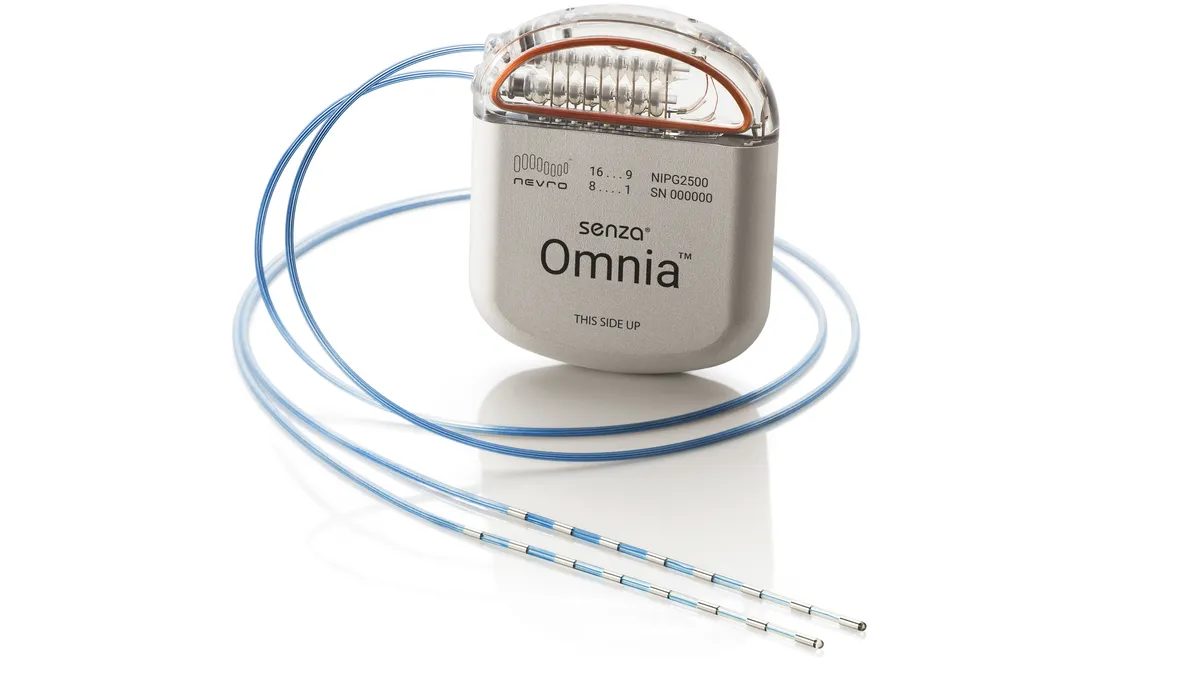

Globus to buy Nevro for $250M

Analysts said Nevro’s valuation was “inexpensive,” but the spinal cord stimulation business can benefit from Globus’ scale and orthopedic relationships.

By Elise Reuter • Feb. 6, 2025 -

Zimmer touts ASC opportunity with Paragon 28 purchase

With the $1.1 billion acquisition, Zimmer Biomet expects its sports medicine, extremities and trauma segment will outpace hips and knees.

By Elise Reuter • Feb. 6, 2025