GE HealthCare lowered the expected impact from tariffs on its financial outlook Wednesday and said customer demand for capital equipment remained healthy in the second quarter.

The medical imaging company boosted its forecast for organic revenue growth in 2025 to 3%, up from a range of 2% to 3%.

However, shares in the company fell nearly 8% to end at $71.64 on the New York Stock Exchange, as investors focused on slower-than-expected order growth and a delayed market recovery in China. J.P. Morgan analysts, in a Wednesday note to investors, said second-quarter order growth of about 3% year over year was below the 5% that investors wanted, and the outlook for China was disappointing.

GE HealthCare CEO Peter Arduini told analysts on the earnings call that the situation in China continues to evolve.

“I'd say China, we're seeing activity pick up, but the market recovery is taking a little bit longer,” said Arduini. “We think the longer-term outlook will be positive just based on the size of the country.”

Still, with greater clarity from deals struck between the U.S. and global trade partners, GE HealthCare now expects a 45-cent tariff impact to adjusted earnings per share for the full year, roughly half of the 85-cent hit it projected last quarter. The reduction is similar to revised outlooks from other large medical device makers, such as Boston Scientific and Johnson & Johnson, which also halved their tariff impact forecasts.

GE HealthCare raised its full-year outlook for adjusted EPS to a range of $4.43 to $4.63, from the previous forecast of $3.90 to $4.10. The improved outlook follows the company’s steep earnings guidance cut in April.

For 2026, tariff expenses are expected to be below the 45 cents forecast for 2025 due to mitigation efforts that include supply chain restructuring actions and selective price increases.

CFO Jay Saccaro, on the earnings call, said the company is working on longer-term changes to the supply chain, such as investing in more local manufacturing and shifting capacity within supplier networks to more tariff-friendly locations.

“As we've seen these trade deals shape up, we're now in a position to begin to execute on some of these, which we'll do in the second half of the year, and then those will benefit 2026,” Saccaro said.

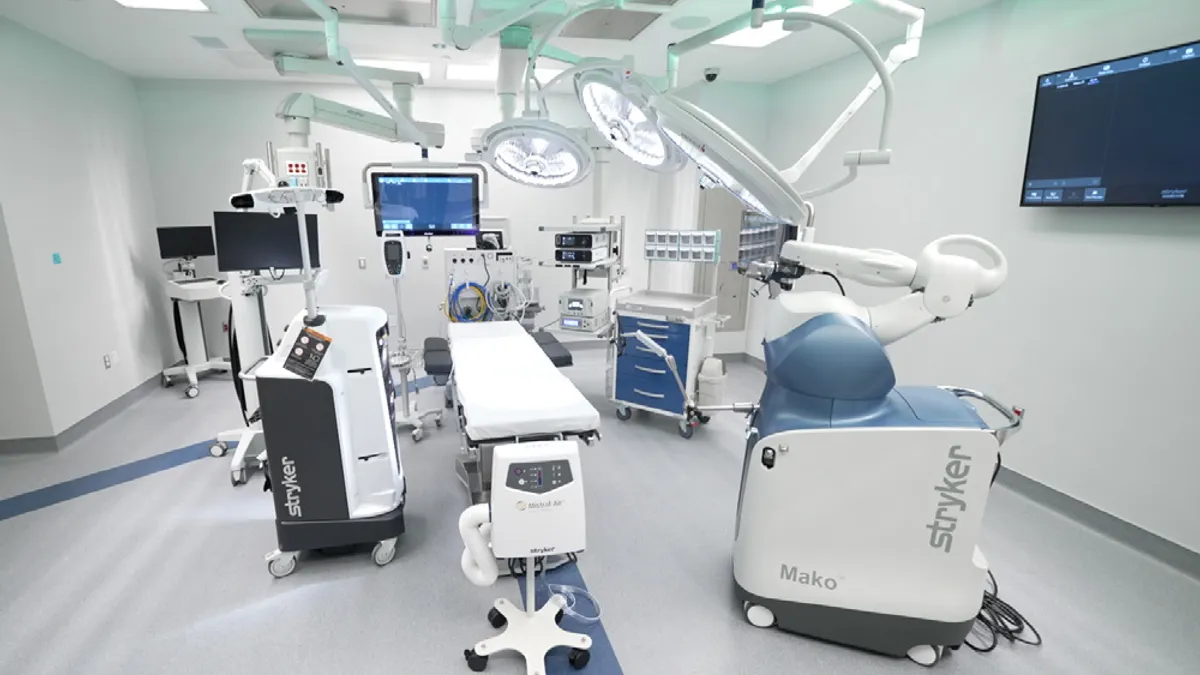

Capital equipment investment

Republicans’ “Big Beautiful Bill” has sparked concerns among healthcare investors that patient volumes could soften if people lose insurance coverage, with the trend in turn pressuring hospital budgets.

GE HealthCare, however, is seeing a “robust” capital environment and healthy procedure growth, said Saccaro, with customers continuing to invest in innovative imaging equipment.

In the U.S., hospitals are replacing an aging installed base of equipment, after the replacement cycle was paused during the COVID-19 pandemic, said Arduini. Further driving demand is a need for imaging to support treatment advances in areas such as electrophysiology and pharmaceuticals that require more follow-up. Hospitals also want equipment that helps increase productivity.

“It's difficult for U.S. hospitals to get staffed, and so equipment that moves the patient swiftly through the institution with a high-quality diagnosis is a very important asset,” said the CEO.