Dive Brief:

- Medical and surgical products provider Medline has filed for an initial public offering in the U.S., the company said Tuesday.

- The planned listing, which Reuters reports could raise $5 billion at a $50 billion valuation, follows a six-month period in which the company grew sales almost 10% to reach $13.5 billion.

- Medline named multi-year preferred supplier deals, international expansion and takeovers as ways it will drive further growth.

Dive Insight:

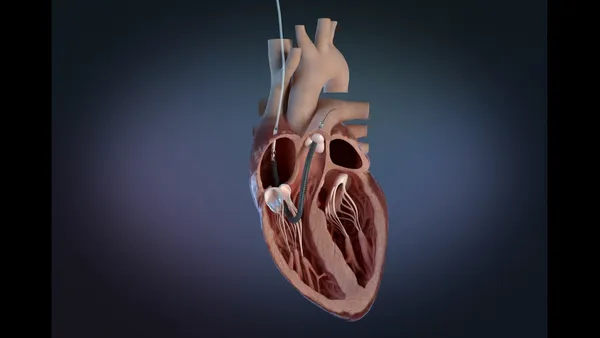

Founded in 1966, Medline today provides around 335,000 products from 33 manufacturing facilities and 69 distribution centers. The portfolio includes surgical and procedural kits, gloves and protective apparel and other medical-surgical products. Medline grew net sales from roughly $10 billion to $20 billion from 2017 to 2021 and increased revenues each year since then.

The company told potential investors that its in-house distribution capabilities differentiate it from other manufacturers of medical and surgical products. As a distributor, Medline has direct access to and manages the end-customer relationships.

Medline said its prime vendor agreements are better value than competitors’ offers. The agreements are multi-year deals that make Medline the provider of the vast majority of a customer’s medical-surgical products. Medline said it has signed prime vendor contracts worth around $8 billion a year over the past six years. Fully converting prime vendor clients to products that Medline makes or sources for sale under its own brand could add $1 billion to profits.

Medline brand products were the subject of a FDA warning letter and recall last year. The actions were part of the FDA’s clampdown on plastic syringes made in China. An import alert restricted the company’s ability to source its own brand of syringes, the company said in the IPO paperwork.

The company was also affected by changes to the rules on the use of ethylene oxide to sterilize devices. A Medline facility temporarily stopped operating in late 2019 because the company was yet to meet new state standards for emissions of the gas. The company settled emissions lawsuits but is now pursuing litigation against insurers that denied coverage with respect to settlement payments.

Medline plans to use the IPO money for general corporate purposes. The company is pursuing a global M&A strategy, under which it acquired Ecolab’s global surgical solutions business for $905 million and Sinclair Dental for $195 million last year. Buying Canada’s Sinclair Dental furthered Medline’s pursuit of the $200 billion international market. The U.S. accounted for 93% of Medline sales in 2024.