Dive Brief:

- Abbott won premarket approval for its latest transcatheter aortic valve implantation (TAVI) system, boosting its bid to win market share from Edwards Lifesciences and Medtronic.

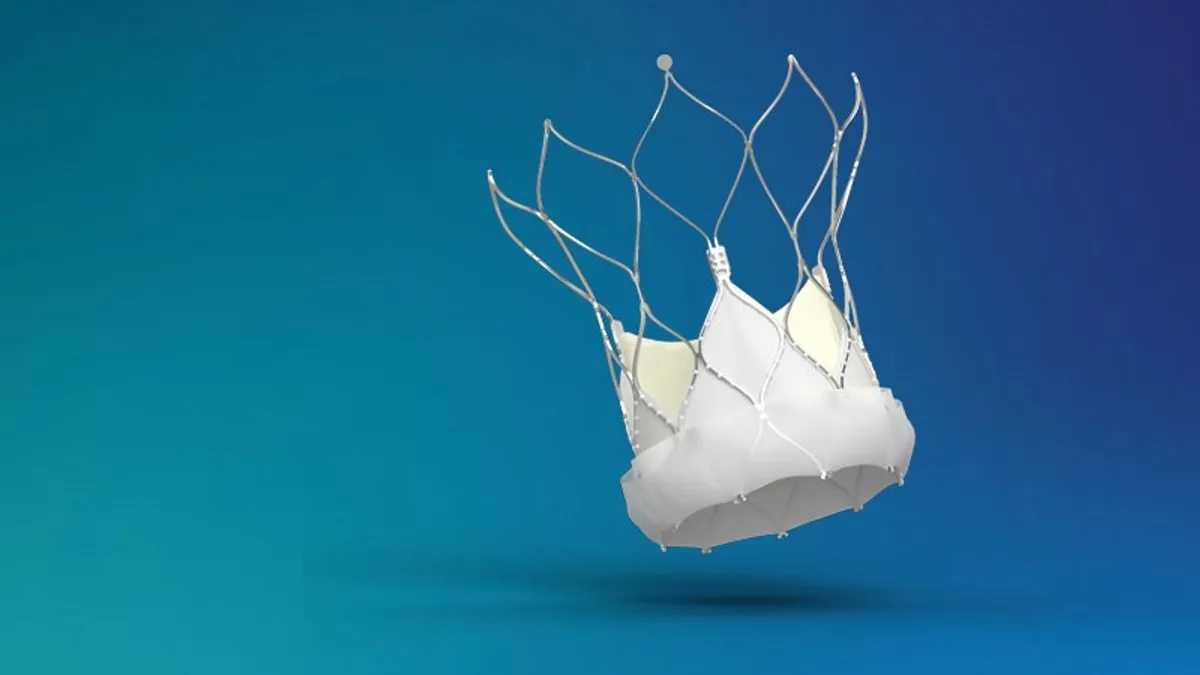

- The Navitor device, which received a CE mark in 2021, has helped Abbott capture about 9% of the European market and is intended to turn the company into a “credible third player” in the U.S., according to analysts at RBC Capital Markets.

- Abbott highlighted Navitor features such as a fabric cuff designed to limit the backflow of blood as differentiators of its device. Still, analysts expect it to have little near-term impact with the RBC team tipping its U.S. market share to grow from 1.7% this year to 2.7% in 2027.

Dive Insight:

Edwards and Medtronic already have held off a challenge from one company, Boston Scientific, that tried to increase its share of the U.S. TAVI market. Boston Scientific withdrew its challenger from the U.S. after a little more than one year on the market, turning the fast-growing sector into a duopoly. Abbott later brought a TAVI device, Portico, to the U.S. market and has largely competed on price, according to RBC’s analysts.

Now, Abbott seeks to compete on features. The new Food and Drug Administration approval covers the only self-expanding system “featuring leaflets within the native valve, which improves access to the coronary arteries, making it easier to treat future coronary artery disease,” the RBC analysts wrote in a note to investors. Other features include the cuff for reducing the backflow of blood — a phenomenon known as a paravalvular leak — and a delivery system designed to accommodate small vessels.

“[Abbott] has seen good success with Navitor in Europe with mid-teens share in accounts where it is available as per the company, and aims to be a meaningful third player in the U.S.; if successful, it could drive upside to our estimates as we are modeling only single digit U.S. share for [Abbott] throughout our projection period,” the RBC analysts wrote. “Overall, we are encouraged by Navitor's approval and expect 2023 to be a 'big year' for pipeline initiatives within ABT's Medical Device franchise.”

The RBC analysts expect Abbott to generate TAVI sales of $58 million in the U.S. this year, an estimate that‘s at the upper end of the range of predictions made by their peers. By 2027, the RBC team is confident Abbott can grow its U.S. TAVI franchise to $135 million, which would give it a 2.7% share of the market.

The analysts expect Edwards to maintain its market-leading position in the U.S. and globally.