Dive Brief:

- The Department of Health and Human Services late Thursday announced a $760 million contract award to Abbott Laboratories for 150 million rapid, point-of-care COVID-19 antigen tests to be deployed in 2020 to schools and vulnerable U.S. populations.

- The Abbott deal comes just one day after the company's $5 test received FDA emergency use authorization. BD, Quidel and LumiraDx previously got the agency's nod for their antigen diagnostics, all of which turn around results in about 15 minutes. However, the Abbott BinaxNOW COVID-19 Ag Card does not require instrumentation and has an immunoassay that, like a pregnancy test, displays colored lines on a test card to show whether a sample contains SARS-CoV-2.

- HHS said Abbott is the only manufacturer with the capability to immediately scale up to meet the urgent need for antigen testing across the country. BD and Quidel have both been increasing output to support demand for their antigen tests, including 10 states that ordered 5 million units. HHS last week invoked the Defense Production Act, pushing the two companies to prioritize the delivery of the diagnostics to 14,000 nursing homes nationwide.

Dive Insight:

Some public health experts have been advocating for a broader coronavirus testing push using antigen tests, especially as commercial laboratories such as LabCorp and Quest have struggled to keep up with increasing demand for molecular diagnostics. Despite the fact that antigen tests are more likely to issue inaccurate results, the faster turnaround times and lower costs of these diagnostics has spurred the push for such testing.

The EUA granted to the Abbott test this week may eventually clear the way for a nationwide effort while removing potential barriers to antigen testing such as capacity and cost.

While BD's plan is to produce 8 million antigen tests a month by March, and Quidel looks to make 7 million tests per month, Abbott on Wednesday said it will ship "tens of millions" of BinaxNOW COVID-19 Ag Card tests next month and ramp up to a 50 million monthly run rate by the beginning of October.

Still, the Abbott test as of now is only cleared for use in healthcare settings, not at home or for those without symptoms.

"With the current EUA approval this test has — it simply wont be the test, right now, to create herd effects and rapidly drop population prevalence," Harvard epidemiologist Michael Mina tweeted.

Nevertheless, he and others expressed enthusiasm about the potential for scaling up use down the line.

Abbott's $5 antigen also has these two companies beat when it comes to cost. HHS is paying BD and Quidel between $20 and $25 each for their tests that run on instruments.

"The BinaxNOW COVID-19 Ag Card test uses nasal swabs and is simple to use, inexpensive, and can be easily employed by medical personnel or trained operators in certain non-clinical environments operating through a CLIA certificate," HHS said.

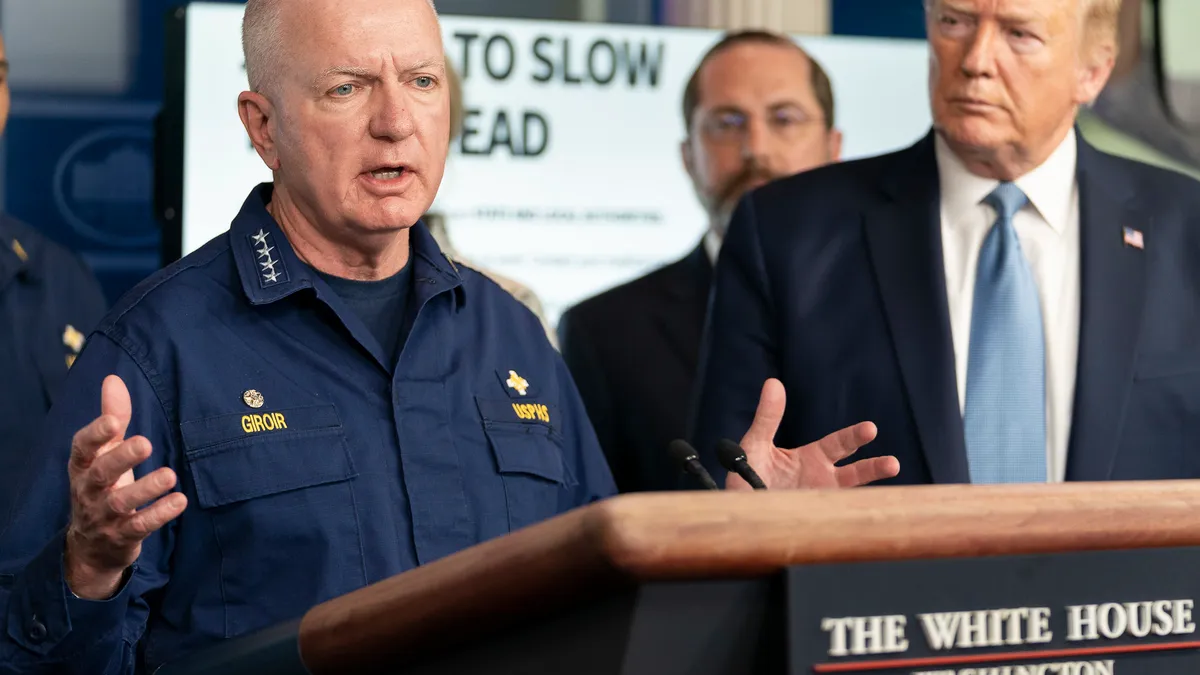

HHS sees Abbott's antigen test as the best diagnostic platform for mass testing on a national scale in order to "safely and sensibly" reopen the country, according to Assistant Secretary for Health Brett Giroir, who said in statement that the Trump administration is "now prepared to fully deploy this new testing asset."

Quidel issued a statement on Thursday welcoming Abbott's entry into the COVID-19 antigen testing market with lower product pricing, which the company said was fully anticipated. The smaller company's CEO Douglas Bryant emphasized that "another entrant into the segment doesn't change our plans to develop or manufacture any of the products in our pipeline, doesn't change our marketing plans, and has no impact on our financial forecast at this time."

Bryant noted that some state public health officials have questioned the "validity" of rapid antigen tests, but said, "together with Abbott, BD and perhaps others, we can begin to change this mindset and to expand the utility and demand for this technology."

Quidel's stock was trading lower Friday morning following a more than 20% decline in its share price on Thursday. BD's stock was down a modest 3% on Thursday and 2% on Friday morning. Abbott stock jumped 7.9% on Thursday after the company announced EUA, and on Friday morning was up less than 1% in trading.