A clean extension of enhanced tax credits for Affordable Care Act plans is looking increasingly unlikely after a Senate Finance Committee hearing on Wednesday in which Republicans were almost totally united in opposition.

“Both sides agree that the cost of healthcare is too high. But sending billions of dollars to insurance companies while premiums continue to rise and the deficit continues to grow is not the only solution,” Chairman Mike Crapo, R-Idaho, said.

Democrats have been urging their Republican counterparts to consider a one-year extension to help Americans avoid looming sticker shock. Premiums will skyrocket for ACA plans next year if the enhanced subsidies are allowed to expire, causing an estimated 4 million Americans to become uninsured.

After it sidesteps the current crisis, Congress can pivot to more comprehensive healthcare reform with bipartisan support — whether that’s curbing problematic insurer business practices or cracking down on middlemen in the pharmaceutical supply chain, Democrats said during the hearing.

“There is no way for Congress to put together a proposal in the next couple of weeks that’s going to help people in January. It just can’t be done. A clean extension this year is the bare minimum of what’s necessary,” said Sen. Ron Wyden, D-Ore., the ranking member of the Senate Finance Committee.

But their pleas seemed to fall on largely deaf ears. Only one Republican — Sen. Thom Tillis, R-N.C. — expressed support for temporarily preserving the subsidies in their current form. Tillis, who is not seeking reelection next year, said that would give Congress time to phase out the financial assistance without harming the 24 million Americans who receive coverage on the ACA exchanges.

“It makes more sense to extend it and bend the curve in the out-years,” Tillis said.

The looming affordability cliff fueled the record-long government shutdown this fall, which ended after Senate Republicans agreed to vote on a bill on the issue this December. Republicans did not commit to the clean extension that Democrats generally support.

The gridlock ate into the already short window that Congress had to avert impending sticker shock. Now — with less than one month left to enroll in benefits beginning Jan. 1 — legislators don’t have enough time to enact anything besides a pure extension, health policy experts say.

Tillis’ colleagues in the committee disagreed. During the hearing, Republicans slammed the ACA as fundamentally broken and stumped for systemic reform of the insurance markets set up by the Obama-era law — whether or not there’s time to enact it before premiums spike.

“Some will argue that time has run out to consider alternatives to extending the credits. I encourage my colleagues to avoid this conclusion,” Crapo said.

‘The only feasible option’

Congress put enhanced premium tax credits in place during the coronavirus pandemic as a measure to get as many Americans insured as possible during the public health crisis.

Specifically, lawmakers removed the cap on eligibility for tax credits for enrollees with incomes higher than 400% of the federal poverty line, while limiting premiums to at most 8.5% of household income. As a result, most low-income enrollees pay nothing or next to nothing for their plan, and coverage became much more affordable for middle-income Americans.

However, many Republicans in the Senate Finance Committee said on Wednesday that the enhanced subsidies should be allowed to expire, arguing their existence is indicative of larger issues with the ACA. The 2010 law created markets that are overly regulated, give too much power to insurance companies and include a subsidized structure that puts inflationary pressure on premiums, they said.

Instead, Congress should create a new system of financial assistance that gives consumers more control over their healthcare.

“Republicans and frankly both sides of the aisle should not perpetuate the mistakes that accelerated Obamacare’s failures,” Sen. Steve Daines, R-Mont., said.

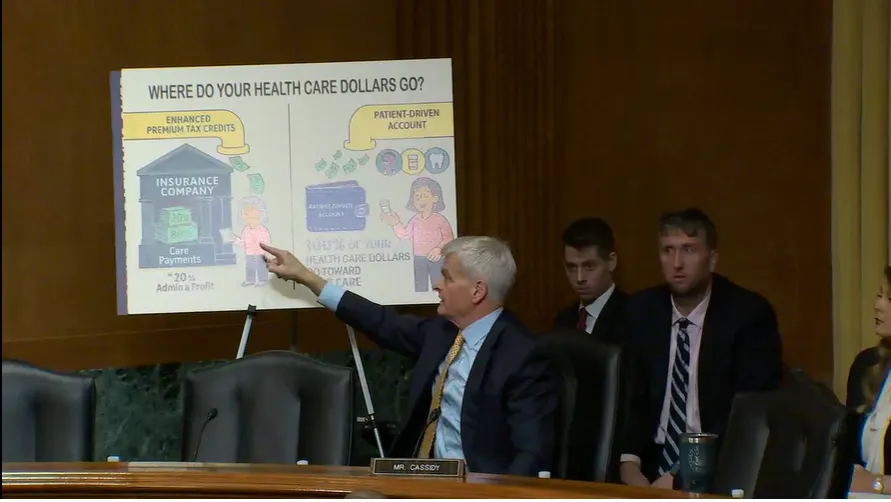

Republicans bandied about a number of alternative proposals that mostly boil down to sending federal dollars directly to consumers, though particulars vary.

For example, Sen. Bill Cassidy, R-La., stumped for his own plan to send more money into the tax-advantaged health savings accounts tied to bronze-level plans in the exchanges.

Republicans also debated the idea of allowing ACA enrollees to receive cost-sharing reductions, which are meant to make silver plans more affordable for low-income Americans, as deposits to an HSA instead of sending the savings to insurers.

Brian Blase, president of the influential conservative think tank the Paragon Health Institute, called the policy a “no-brainer” during the hearing.

Still, Democrats and other market experts at the hearing argued that sending money into enrollees’ accounts isn’t a substitute for comprehensive health insurance.

In addition, any proposal besides a pure extension of subsidies would be logistically impossible before the end of the year, testified Jason Levitis, a senior fellow in the left-leaning Urban Institute’s health policy division.

It would take state and federal marketplaces months to build, test and deploy the IT systems needed for many of the Republican proposals, he said. In comparison, marketplaces have prepared for the possibility of an extension and many could update their systems to reflect one within days.

“In recent days we’ve seen a flurry of new ideas to change the enhanced tax credits or replace them with something else. It’s certainly worth considering longer-term options to lower healthcare costs. Unfortunately the calendar has overtaken the opportunity to implement such changes for 2026,” he testified. “At this point the only feasible option is a clean extension of the existing enhancements.”

Douglas Holtz-Eakin, the president of center-right policy institute American Action Forum, agreed that Congress doesn’t have enough time to overhaul the ACA markets before premium pain sets in next year.

Lawmakers could appropriate additional funds for people in bronze ACA plans who already have access to an HSA, but “you can’t do much to the fundamental working of the market at this point,” Holtz-Eakin said.

Some House Republicans have said they’re open to a one-year extension of the funds while Congress debates a longer-term solution. However, President Donald Trump has said he won’t accept any policy that retains the current subsidy structure, posting in all caps on social media Tuesday that “the only healthcare I will support or approve is sending the money directly back to the people.”

The president has spent much of the past week railing against health insurance companies, arguing that the subsidies are fattening their profits instead of helping consumers. Republicans echoed those concerns during the hearing, while reupping concerns that the assistance has fueled rampant fraud on the exchanges. Conservatives are also leery about the price tag of extending the help — some $335 billion over the next decade, according to the Congressional Budget Office.

Democrats agreed that the current insurance system is far from perfect, but argued that American families shouldn’t be penalized for it next year.

“If we wanted to come up with these cost saving ideas — and we have several good proposals from these eminent witnesses — we should have been working on that a year ago. We do not have time. We do not have time, in 26 days, to change things,” said Sen. Peter Welch, D-Vt.

If and when the premiums expire on Dec. 31, some low-income enrollees will find themselves paying premiums for the first time, while any person making more than about $64,000 annually — just over 400% of the federal poverty level — will lose financial assistance altogether.

One such individual, Bartley Armitage, a former construction worker from Eugene, Oregon, was a witness at the hearing. Currently, he and his wife pay $443 a month for their ACA plan. Come Jan. 1, that’s going to increase to $2,224 a month — more than five times what they were paying before.

“Making healthcare affordable for everyone is the type of thing that we expect our tax dollars to go toward in a country like the United States where it’s a good country, it’s a strong country and it’s a rich country,” Armitage testified. “People should not have to go without care.”