Dive Brief:

- Carlsmed has set the target range for its initial public offering, outlining plans to raise up to $103.3 million to support development and commercialization of its spine surgery platform. Carlsmed plans to offer 6.7 million shares of common stock at an expected range of $14 to $16 per share, as well as an underwriters' option to purchase more than 1 million shares.

- The company, which set the price range Tuesday, sells artificial intelligence-enabled software, custom implants and single-use instruments for spine surgeries. Cross-trial comparisons suggest the custom devices may improve alignment and reduce revisions compared to stock implants.

- Carlsmed’s products compete with stock spine implants sold by companies including Medtronic, Johnson & Johnson and Globus Medical. The company is much smaller than its rivals but growing quickly, with sales increasing by almost 100% in 2024 and on track to rise again this year.

Dive Insight:

Carlsmed is developing its platform to address the limitations of traditional spine fusion procedures. The company has identified the lack of sufficient pre-operative planning, the fit of stock interbody implants and complicated surgical workflows as problems. Targeting a $13.4 billion addressable market, Carlsmed is working to address these issues to improve patient outcomes and cut healthcare costs.

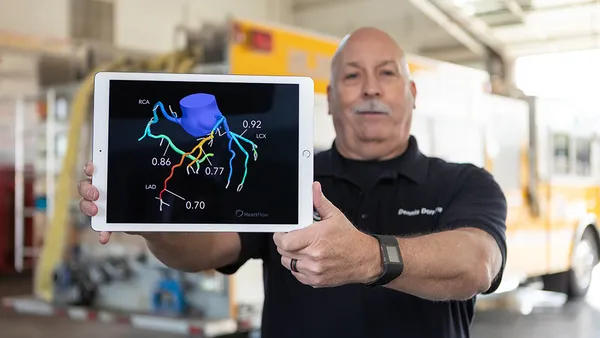

The resulting platform uses diagnostic imaging and AI-enabled algorithms to develop personalized digital surgical plans and design custom interbody implants for each patient. Carlsmed collects real-world, post-operative data to improve the planning process.

Researchers have generated evidence of the effectiveness of the platform, including through a registry that is tracking real-world clinical outcomes. An interim analysis of 67 adult spinal deformity patients in the registry found the rate of revision surgery attributable to mechanical complications was 1.5% after a mean follow-up of 14.7 months, according to a federal securities filing. The one-year revision rate in another study of stock implants was 8.7%.

Carlsmed reported revenue of $27.2 million last year, up almost 100% compared to 2023, and is on track to grow again in 2025. The company generated sales of around $22.2 million over the first half of 2025. Carlsmed plans to keep growing by adding users and increasing use by existing customers. The number of surgeons who have used the platform increased from 103 as of March 2024 to 199 as of June 2025.

Carlsmed’s IPO paperwork reveals some of the challenges the company is facing as it scales operations. The company’s net loss increased last year, rising to $24.2 million, and its reliance on a limited number of contract manufacturing organizations has hurt margins.

Delays in the approval of surgical plans or late changes in surgery dates can cause CMOs to charge expedite fees. The fees drove margins down in the second quarter. Carlsmed expects expedite fees to decrease over time as it tries to improve operational processes and procedural workflows used by surgeons.

Carlsmed’s filing to list on Nasdaq adds to the uptick in medtech IPO activity seen this year. IPO filings are still well down from the pandemic-era peak but, after years of limited activity, some analysts believe a backlog of companies is waiting for favorable conditions to list. The success or failure of companies such as Carlsmed could inform whether the IPO window opens or closes.