Dive Brief:

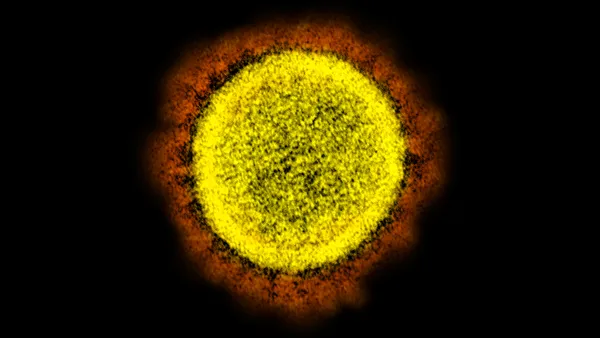

- Surging COVID-19 cases and hospitalizations spurred by the delta variant slammed U.S. hospitals and health systems in August, according to Kaufman Hall's latest hospital flash report.

- Hospital margins in the month were below pre-pandemic levels from 2019, not including federal relief funding from the Coronavirus Aid, Relief and Economic Security Act passed last March. Most volume metrics were also down compared to pre-COVID-19, but up from historic lows notched in the first eight months of 2020 when pandemic mitigation measures hampered demand.

- The ripple effects of the delta surge have hit top companies in the medical device sector. Medtronic, Zimmer Biomet and Boston Scientific have all cautioned that the procedure shutdowns from the delta surge will drag businesses this quarter.

Dive Insight:

The future of the pandemic is still being written, but it's looking increasingly unlikely that COVID-19 will be completely eradicated anytime soon. Public health officials are continuing to stress the importance of vaccinating the largest swath of the population possible, but despite the widespread availability of efficacious vaccines, some 23% of the U.S. has yet to receive a single shot, according to the Centers for Disease Control and Prevention.

Persistent vaccine hesitancy in some groups combined with the rise of the hyper transmissable delta variant has resulted in increased stress on hospitals in the summer months, though recent metrics are more promising.

New infections and hospitalizations are declining nationally, though some states continue to see growing outbreaks. Cases are down 18% compared to two weeks ago, while hospitalizations are down 15%. However, deaths are up 23%, per a tracker maintained by the New York Times.

The drop in non-emergency procedure volumes has had a large impact on procedure-dependent medtechs, which often rely on the procedures to drive revenue. After shutdowns in 2020 spilled over into this year, the industry began rebounding at the end of the first quarter and most companies returned to or even eclipsed pre-pandemic levels in the second quarter.

However, the return of delays and shutdowns of care has disrupted the industry's return to form. Boston Scientific CEO Michael Mahoney said last week during an investor day event that the company faced an "unprecedented shutdown" of procedures in August and September, particularly in U.S. hot spots. As a result, the company does not expect to hit its third-quarter guidance.

"COVID-19 rates appear to be tapering in September, but the August data show we are not out of the woods yet, and hospitals face additional uncertainties as we move into the fall and winter," Erik Swanson, a senior vice president of data and analytics at Kaufman Hall, said.

The average length of stay increased compared to 2019 and 2020, as hospitals saw a rise in high-acuity cases requiring longer stays. Meanwhile, expenses continued to rise, while revenues increased for a sixth consecutive month, the consultancy found.

The median change in hospitals' operating margins was down 2.9% year-to-date compared to pre-pandemic levels in the first eight months of 2019, not including help from CARES, according to the new flash report, which draws on data from 900 U.S. hospitals.

However, factoring in government assistance, the median change in operating margin rose 11.2% versus January to August 2019, Kaufman Hall said.

Revenues and expenses also jumped on a year-to-date basis versus 2019, mostly due to a greater number of high-acuity patients — including COVID-19 cases, the consultancy said. Gross operating revenue was up 9.6% compared to 2019, while total expense per adjusted discharge was up 16.6%.

Meanwhile, volumes continue to suffer from the pandemic. Though average length of stay was up 7.9%, reflecting higher acuity, adjusted discharges, emergency room visits and operating room minutes were down 4.8%, 11% and 1%, respectively.

Ricky Zipp contributed reporting.