Dive Brief:

- Venture capital investment across the healthcare sector slowed in the first half of the year, but health tech funding was a bright spot — buoyed by growing interest in artificial intelligence, according to a report published Tuesday by Silicon Valley Bank.

- Overall healthcare investment and deal count declined, but health tech startups in the U.S. and Europe raised $8.2 billion across 358 deals, the best first half recorded in the segment since early 2022.

- The performance was driven by a boost in funding for companies using AI, especially for administrative and back-office use cases. “From a VC perspective, these business models can be very sustainable, and there is a clear path to profitability,” said Jackie Spencer, head of relationship management for life science and healthcare banking at SVB.

Dive Insight:

Overall, the first half of 2025 was a challenge for healthcare fundraising. Funds in the sector are on track for the lowest capital closed in more than 10 years, according to SVB.

Healthcare companies — which include biopharma, health tech, medical device, and diagnostics and tools startups — are lagging this year. Firms in the U.S. and Europe scooped up $26.7 billion across 1,318 deals in the first half this year, compared with around $29 billion in more than 1,400 deals last year.

One challenge for investment and fundraising this year is macroeconomic uncertainty — including trends that have carried over from last year, Spencer said.

“In 2024, we talked so much about the interest rate environment and the uncertainty around inflation and international conflicts as being a reason for a lot of the pullback in fundraising and investment,” she said. “Those things still exist, right? Interest rates are still high.”

Plus, there are new economic questions for investors and startups. Tariffs could be a significant financial hit for companies that source components outside the U.S., while cuts to National Institutes of Health funds could hinder innovation down the road, according to SVB.

The health tech segment is facing its own uncertainties too, from the impact of cuts to Medicaid in the recently passed tax and policy law to medical cost increases in Medicare Advantage — a concern as payers in the privatized Medicare program drive tech adoption to attract enrollees and keep expenses down, according to the report.

However, health tech has performed well so far this year: The segment made up about one-third of overall healthcare investment, its largest proportion since 2021, according to SVB. Just over 60% of health tech funding is linked to companies that use some form of AI, Spencer said.

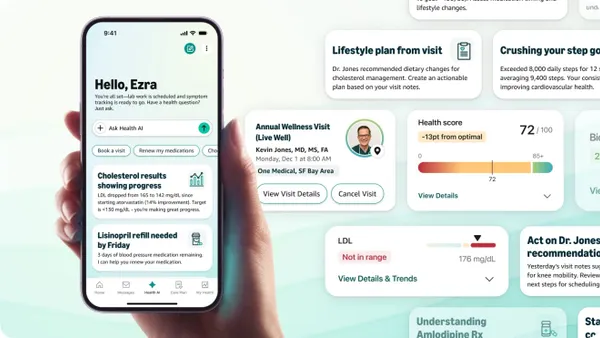

Back-office use cases for AI have become a large focus for investment. Tools aimed at lessening administrative work rather than clinical tasks made up 44% of AI funding in the first half of the year, according to SVB.

“There’s an obvious use case for it, and there’s a clear cost savings that can be shown to ultimately the buyers of the technology,” she said. “Not to mention, the back office in healthcare is very, very convoluted, very archaic. It’s ripe for disruption.”

Health tech has also seen two initial public offerings this year — virtual musculoskeletal firm Hinge Health and chronic care management company Omada Health — after a long dry spell in digital health IPOs.

Still, the IPO market will likely continue to be “highly selective,” Spencer said. Health tech companies that went public over the past decade that performed poorly are still weighing down the sector’s performance, and they could be holding back newer firms, according to the report.

For other exits, health tech has already notched several high-dollar mergers and acquisitions this year, with almost as much spent on private M&A so far in 2025 as the past three years combined.

Non-traditional buyers, like venture-backed companies with available cash, are one avenue for M&A, Spencer said. For example, Waystar, a healthcare payments firm that went public in 2024, recently signed a definitive agreement to buy AI-backed revenue cycle management company Iodine Software.

Plus, private equity firms are still actively buying and rolling up point solutions, Spencer added.

“I anticipate M&A to be a bit rosier of a story,” she said, “just because there are multiple buyers and there is still a lot of capital out in the market.”