Dive Brief:

- Heartflow has filed for an initial public offering to repay debt and fund commercialization of its coronary artery disease software.

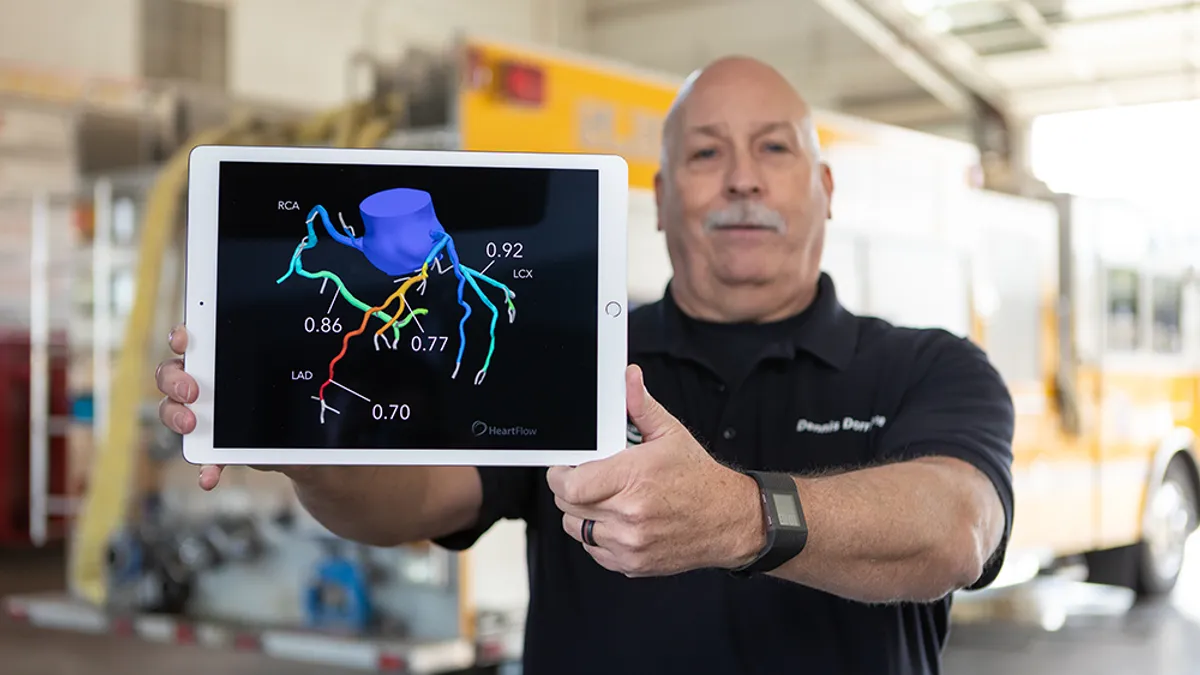

- The company, which submitted the paperwork Thursday, has developed software that creates 3D models of hearts from coronary computed tomography angiography scans. Heartflow found the platform was 78% more likely than usual care to identify patients in need of revascularization.

- Heartflow views Siemens Healthineers, GE Healthcare, Philips and Canon Medical Systems as its main competitors.

Dive Insight:

Heartflow has developed three products, plus a fourth expected to launch in 2026, but its revenues are currently heavily reliant on software for analyzing fractional flow reserve. The software, called Heartflow FFRCT Analysis, accounted for 99% of total revenue as of the end of March, according to the company’s securities filing. Physicians use the software to calculate blood flow and identify clinically significant coronary artery disease.

The company has validated the software in multiple trials. One study enrolled more than 2,100 people without known coronary artery disease or prior testing. Heartflow found its platform identified more patients in need of revascularization and cut the need for diagnostic-only invasive coronary angiography, leading the company to calculate a 20% increase in net revenue for cardiac catheterization labs.

Heartflow reported revenue of $37.2 million in the first quarter, up 39% year over year. The company grew revenues by 44% year over year in 2024 to generate $125.8 million. Heartflow said it has “had some recent success in achieving broader adoption” of the platform, but told investors it has faced “challenges in achieving higher rates of adoption” in the past. The challenges may resurface, the company said.

Heartflow said in the past it has “experienced software code defects and software release process defects that have resulted in intermittent interruptions to the physician’s ability to use” the platform. A subset of these defects were reported to the FDA.

The platform relies on CT scans taken by equipment made by other companies. Heartflow said Siemens, Philips and Canon have considered developing local workstation-based technology prototypes aimed at deriving CT-based blood flow data without an invasive procedure. Such technology could compete with Heartflow. The companies could also bundle competitive software with CT scanners, Heartflow said.

Heartflow is yet to price the IPO. A loan agreement requires the company to use the IPO money to pay a creditor $50 million, or $55 million if underwriters take up their option to buy more shares. Heartflow will use the remaining IPO funding, plus its existing cash, to fund sales, marketing and R&D.

The company ended March with $109.8 million in cash and cash equivalents.