Dive Brief:

- Heartflow has priced its planned initial public offering, setting the terms for a Nasdaq listing that could net the heart software company around $180 million.

- The company, which set its IPO range on Friday, expects to offer 12.5 million shares for between $15 and $17 each. At the midpoint of the range, the IPO will net $180.5 million after fees. That figure could rise to $208.4 million if underwriters take up their options to buy additional shares, according to the securities filing.

- Heartflow’s terms suggest the company will have around $130 million of IPO funding left after it has met a debt obligation. The company plans to use the cash for sales, marketing, and research and development.

Dive Insight:

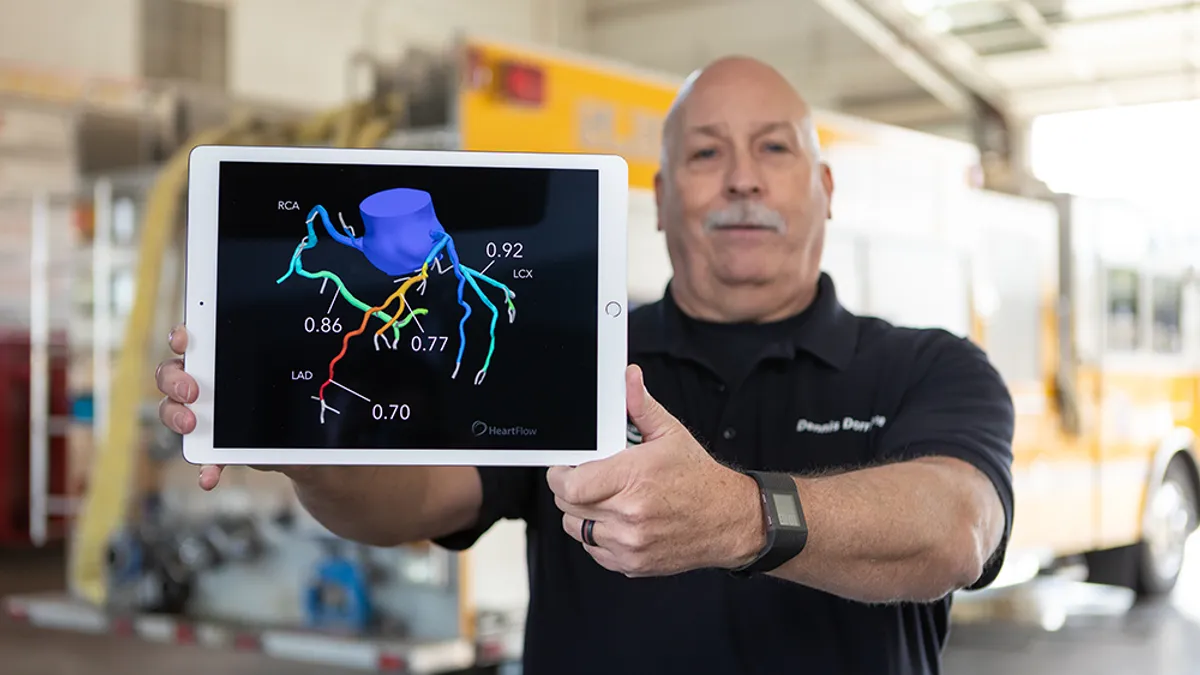

Heartflow sells software for creating 3D heart models from coronary computed tomography angiography scans. The portfolio is led by Heartflow FFRCT Analysis, software that the company’s clinical trial found was 78% more likely to identify patients in need of revascularization than the usual care pathway.

The updated IPO paperwork provides details of how much Heartflow could raise to fund the platform.

Other changes to the amended IPO include updated financial figures. Heartflow reported preliminary unaudited revenue of $42.9 million to $43.4 million for the three months ended June 30, up 38% to 40% year over year. The company attributed the increase to a rise in revenue case volume, which climbed 47% to 48,420.

The company ended June with $80.2 million in cash and cash equivalents, down from $109.8 million at the end of March. Heartflow said the payment of annual bonuses, plus IPO costs and interest on debt, drove the decrease.

Between filing and amending its IPO paperwork, Heartflow said UnitedHealthcare has decided to cover its plaque analysis software from Oct. 1. UnitedHealthcare will cover Heartflow Plaque Analysis across all lines of business, including its Commercial, Medicare Advantage and Community plans.

Heartflow said the coverage decision makes UnitedHealthcare the first insurer to update its policies to cover the software and fully align with recent guidelines from radiology benefit manager EviCore. Last month, EviCore, which provides coverage guidelines to leading commercial health insurers, included the software in its cardiac imaging guidelines.

The FDA cleared the software in 2022, and Heartflow began limited market education efforts in the second half of 2023. Heartflow plans to expand commercialization of the product to diversify beyond its software for analyzing fractional flow reserve, which represented 99% of the company’s total revenues at the end of March.