Q4 Insights:

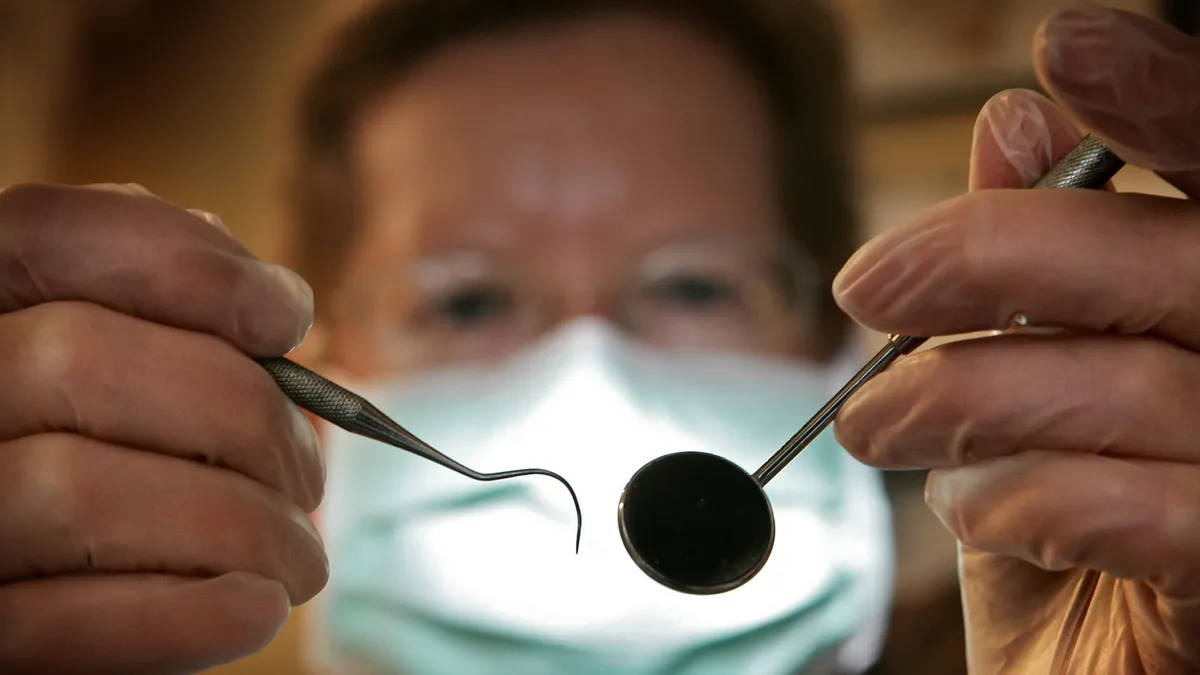

Henry Schein, a leading distributor of medical and dental supplies, posted a decline in profit in the fourth quarter amid waning sales of COVID-19 tests and personal protective equipment (PPE) and as patients continue to cancel dental appointments.

The shares dropped 6.6%, or $5.82, to $82.82 on Thursday after the company announced earnings. The stock was little changed at $82.69 in morning trading on Friday.

“We believe global dental consumable merchandise growth was impacted by the high incidence of flu and COVID-19 cases, which caused increased rates of patient appointment cancelations and accentuated the staffing shortages,” CEO Stanley Bergman said on a conference call with investors. “Now what's important is the rate of patient flow appears to have returned to more normal levels in January. The impact from manufacturing merchandise price increases, we believe, lessened as last year's increases began to annualize.”

Bergman added that the North American equipment order book is stable and price increases have stabilized after a turbulent start to 2022. Most of the cost lines in Henry Schein’s results rose in the quarter. A jump in restructuring and integration expenses also dented profit.

‘Hot’ market faces challenges

Bergman also pointed to a decline in sales of digital restoration equipment in the fourth quarter. While noting that the market is “pretty hot,” the CEO flagged challenges that dented sales over the final three months of 2022.

“The challenge has been customer demand is shifting from chairside mills, quite expensive, to 3D printing, much less expensive, and a mix shift to lower-priced intraoral scanners. There was also a supply chain issue with one of our important intraoral scanner suppliers,” Bergman said.

Over the coming quarters, Henry Schein plans to educate dentists about 3D printing. Bergman expects the education to lead to mill sales increasing again because, in his view, “3D printing is going to be important, but not substitute completely for chairside milling.”

Forecast:

Henry Schein expects sales to grow by 1% to 3% this year even amid a 30% to 35% drop in revenue from PPE and COVID test kits. The loss of pandemic-related business will hit hardest in the first half of the year, particularly the first quarter, the company said.