Dive Brief:

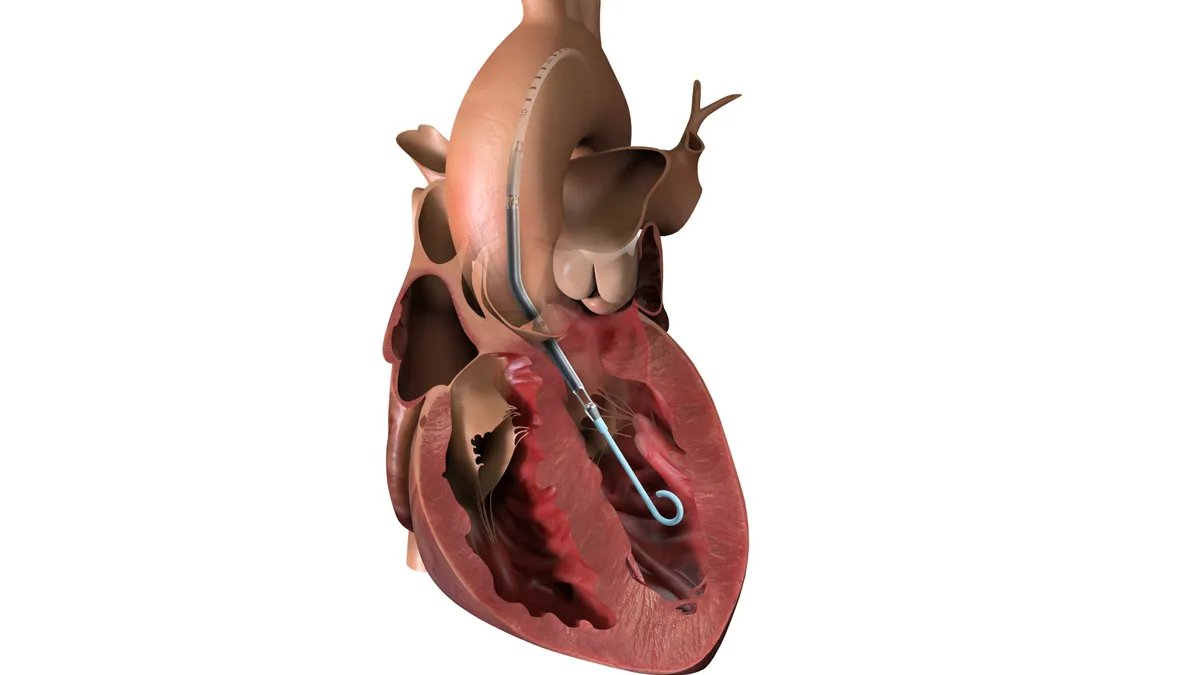

- Johnson & Johnson agreed to acquire Abiomed, a Danvers, Mass.-based maker of heart pumps, for $16.6 billion.

- The deal will contribute to J&J’s cardiovascular portfolio, complementing its Biosense Webster electrophysiology business, BTIG Analyst Marie Thibault wrote in a research note on Tuesday.

- The deal has already been approved by both companies’ boards of directors and is expected to close before the end of the first quarter of 2023.

Dive Insight:

Johnson & Johnson’s new CEO Joaquin Duato said at the start of the year that the company would take a “more aggressive” approach to medtech mergers and acquisitions even as it has largely stuck to smaller deals in a relatively slow year for M&A.

Analysts have speculated that J&J would acquire a cardiology firm such as Boston Scientific.

Duato said in a statement that the acquisition is “an important step in the execution of our strategic priorities” as the company spins out its commercial business to focus on pharmaceuticals and medtech.

“We have committed to enhancing our position in MedTech by entering high-growth segments. The addition of Abiomed provides a strategic platform to advance breakthrough treatments in cardiovascular disease and helps more patients around the world while driving value for our shareholders,” he added.

Priced at $380 per share, or about $16.6 billion total, it would be the largest medtech transaction of 2022. It’s valued at 50% higher than Abiomed’s closing share price on Monday. J&J plans to fund the purchase with cash on hand and short-term financing.

J&J said the acquisition is expected to be slightly dilutive to earnings per share in the first year, then adding $0.05 per share in 2024 and increasingly accretive thereafter.

“The size and the target of this deal catches us off guard. However, we do think [Abiomed] is a high-quality target and fits JNJ's businesses and company culture well,” Thibault wrote.

She added that Abiomed likely won’t face other potential acquirers given the premium offered and the limited number of companies that could make a purchase of this size.

“Reading through to the rest of MedTech, we’re inclined to see this deal as positive,” Stifel Analyst Rick Wise wrote in a research note. “[Abiomed] highlights the importance of growth/innovation for larger companies like [J&J].”

Next steps

While both companies’ board of directors have approved the transaction, it will need regulatory approval and is conditioned on the tender of a majority of the outstanding shares of Abiomed’s common stock.

Abiomed would operate as a standalone business under J&J. Abiomed CEO and Chairman Michael Minogue has established a succession plan, and current Chief Commercial Officer Andrew Greenfield will become the company’s president. Michael Bodner, who is worldwide president of Biosense Webster Electrophysiology, will help lead the integration under the leadership of Ashley McEvoy, J&J’s worldwide chairman of medtech.

Abiomed shareholders could receive as much as an additional $35 per share if the companies reach certain commercial and clinical milestones, including $17.50 per share if net sales for Abiomed products surpass $3.7 billion between the second quarter of 2027 and the first quarter of 2028. In the quarter ending June 30, Abiomed reported revenue of $277.15 million.

Thibault wrote that the sales target is “doable, but not a certainly,” as it represents a 23% compound annual growth rate from today.

Correction: In a previous version of this article, Abiomed’s revenue in the quarter ended June 30 was misstated. It was $277.15 million.