The medical device industry kicked off 2025 similarly to most years: Top companies were spending money.

Stryker, Zimmer Biomet and Thermo Fisher Scientific all announced deals worth more than $1 billion, and Boston Scientific, after a rush of M&A last year, announced a pair of acquisitions that could collectively eclipse that mark. However, activity has since cooled, with few transactions taking place outside of the first two months of the year.

“The number of medtech M&A deals for the first half of the year, technically, is on pace to match last year’s … but it has been really front-loaded,” said Aaron DeGagne, a senior healthcare analyst with PitchBook.

Stryker’s nearly $5 billion pickup of Inari Medical — the year’s highest price tag so far — was announced Jan. 6. Rival Zimmer Biomet revealed it would buy Paragon 28 for $1.1 billion a few weeks later. And Thermo Fisher Scientific agreed to buy Solventum’s purification and filtration business for $4.1 billion in February.

Meanwhile, Boston Scientific’s deal worth up to $664 million for the remaining stake of Bolt Medical and its purchase of Sonivie, worth up to $540 million, were announced in early January and March, respectively.

Since then, the M&A environment has been quiet, with few acquisitions, let alone a billion-dollar or multi-billion-dollar purchase.

Why did dealmaking slow down?

Analysts said in interviews that the slowdown in dealmaking is due to similar factors as the slowdown in initial public offerings after a handful of companies went public in the span of a few months: economic uncertainty and an up-and-down market, largely due to the Trump administration’s tariff policies.

Companies tightened their pocketbooks as the market dropped and questions swirled about the impact of the Trump administration’s trade strategy.

“Part of the reason for [the slowdown] is when you have these transactions, especially as they get into the hundreds of millions — and into the billions — these are deals that are being worked on for not just weeks, but usually worked on for months, or even years,” DeGagne said. “When we get some of these deals announced in January, February, March — I think the ball got rolling on these either early this year or late last year, when I think the market was in a pretty good place.”

Shagun Singh, an analyst with RBC Capital Markets, said companies wanted to see how the tariffs would affect their businesses shortly after the policies were announced, and that they wanted to “see what the headwinds are, what they need to do, how they need to manage it.”

The Trump administration’s tariff policies have affected medtech companies in different ways — some saw little impact, while companies like Johnson & Johnson, Abbott and Boston Scientific projected charges worth hundreds of millions of dollars. Questions still exist about how businesses will move forward as trade tensions with China and other countries have, for now, eased.

John Babitt, a partner with EY, added that deals announced in the first quarter, like Stryker’s and Zimmer’s, would have been “a lot more difficult to get done post-tariff announcement.”

With uncertainty looming around tariffs, specifically, buyers may value companies less if they are exposed to the trade policies, PitchBook’s DeGagne said. He added that an uncertain and complex market in general forces companies to take a closer look at their spending, which can influence whether acquisitions will be made.

“Generally speaking, market uncertainty creates difficult business environments, and so a lot of these big public companies are scrutinizing their costs,” DeGagne said. “They don't know if their customers are going to continue buying, and so … they will be less likely to, probably, go ahead with a high price transaction in that environment.”

Will dealmaking rebound?

Dealmaking is expected to resume in the second half, the analysts said, as the economic environment stabilizes a bit more.

After weathering a turbulent past few months, Singh said companies are “back in a mood where they are thinking about their businesses and thinking about long-term strategies.” And while there is still uncertainty about the future of tariff policies and other macroeconomic factors, companies may still be willing to pull the trigger on M&A when the opportunity arises.

“I don’t think there is expectation that the worst is behind us. I think there is uncertainty right now. I don’t know if there’s a good time,” Singh said. “I think companies are going to be opportunistic.”

EY’s Babitt said that people are “cautiously optimistic” that medtech firms will spend more later this year compared to the first half, adding that his company is seeing that sentiment in “the activity in our business as well.”

One strategy companies are using is a dual-process approach, where they are simultaneously pursuing a sale and an IPO, according to Babitt.

“It drives a little competitive tension to draw investors in,” he added.

Illumina has already broken through the slump, announcing in June that it would buy SomaLogic for up to $425 million. Executives from some of the industry’s biggest spenders — Boston Scientific and Stryker — have also signaled that they’re open to continuing their M&A runs.

“We're fine and good to go,” Boston Scientific CEO Mike Mahoney said at a May investor event when questioned if the company would slow down on M&A. He explained that the company is focused on “putting ourselves in faster-growth markets and expanding our category leadership so we can partner with customers better … We think that playbook’s smart. We're effective at it. We are very good at doing integrations.”

Mahoney added that the company is in “enough businesses with so much unmet need that there's plenty of things to look at.”

Meanwhile, CFO Preston Wells said in May that Stryker, which closed seven deals last year, is in a “very good position from a liquidity standpoint, and [we] certainly still have the ability to go out and tap the debt markets if necessary and the right deal comes through.”

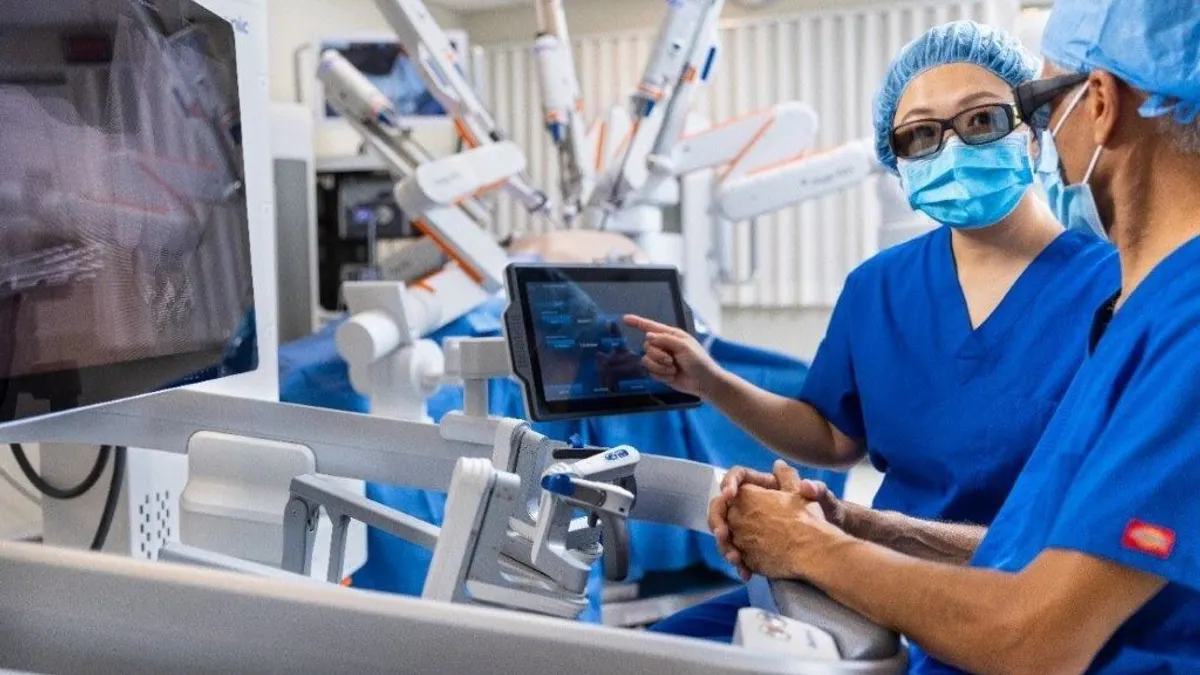

Boston Scientific and Stryker have been some of the most active spenders in the medtech space, pursuing tuck-in deals that allow them to lead in specific business categories. Other medtech companies are expected to pursue similar strategies as the industry continues to move away from simply growing in sheer size.

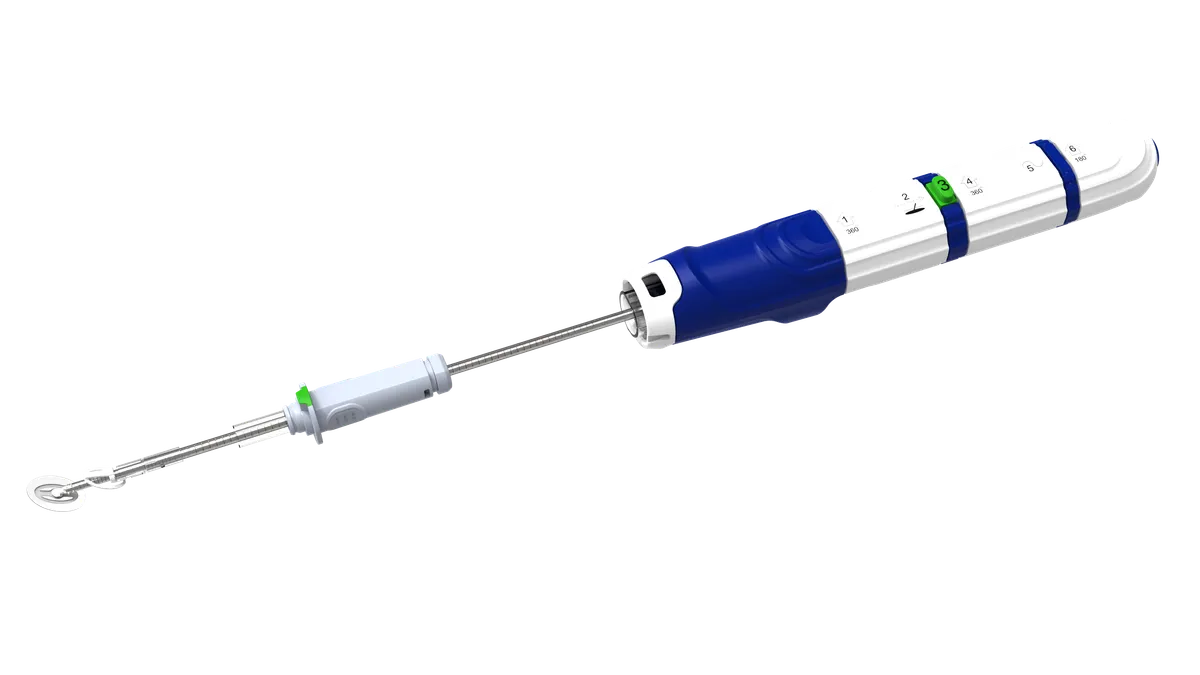

When discussing potential acquisitions, EY’s Babitt called out surgical robotics, pulsed field ablation, structural heart and diabetes as areas that “have a lot of growth and therefore interest.” He did not name specific companies in terms of targets or buyers.

RBC’s Singh believes the M&A environment is wide open.

“It's going to be all over the place,” Singh said. “I really think that it's going to be diverse.”

While the number of total transactions may not reach the heights of prior years, largely due to the months-long slowdown, the industry could see M&A pick up in the near future.

“M&A is just going to continue. I think it's the lifeblood of medtech,” Singh said. “You're not going to pass up an opportunity because of tariffs if you can get into a multi-billion dollar market and you have an asset right in front of you.”