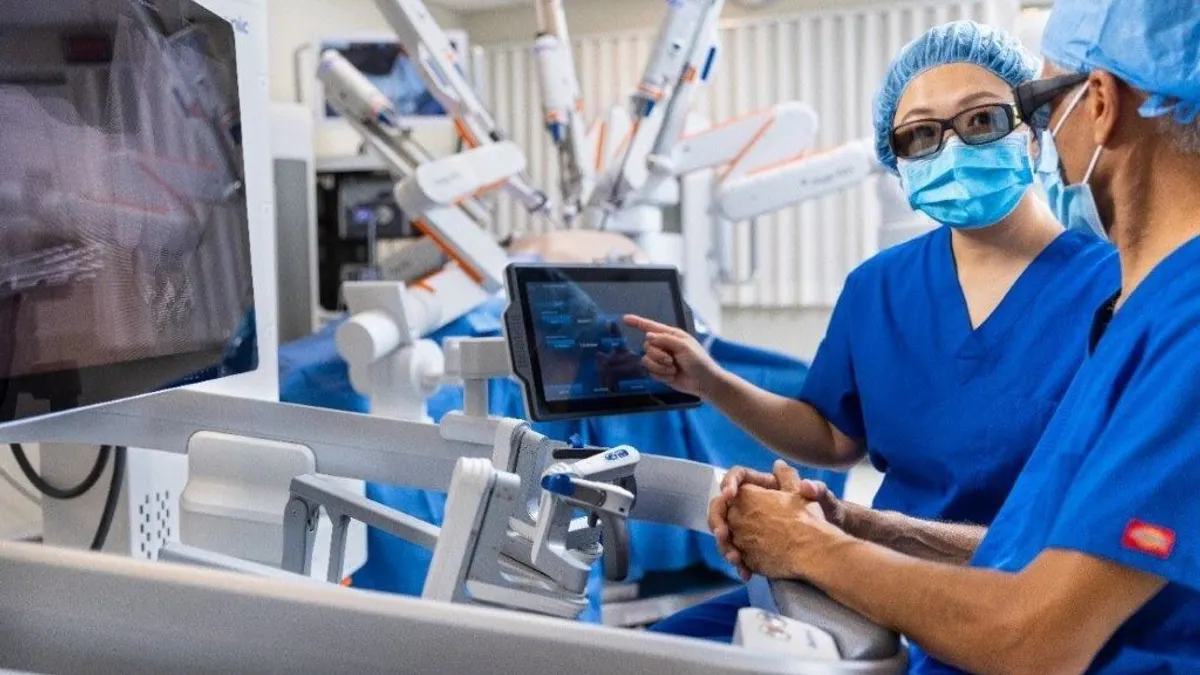

Medtronic said Tuesday that a surgeon completed the first U.S. procedure for its Hugo robotic surgery system, shortly after the company received Food and Drug Administration clearance for the platform.

The first surgery was a prostatectomy procedure performed at the Cleveland Clinic. Along with the Cleveland Clinic, Duke University Hospital and Atrium Health Wake Forest Baptist High Point Medical Center are among the first hospitals in the U.S. to install Hugo, with Atrium Health being the first hospital in the U.S. to do so that was not part of the investigational device exemption clinical study.

CEO Geoff Martha told investors on an earnings call that the first cases were completed earlier this month, with more procedures scheduled this week. Martha did not specify the number of Hugo installations or procedures.

While the robot may not “move the needle” for the company’s surgical business quite yet, Hugo is growing “pretty fast,” Martha said.

“We like where we sit,” the CEO said. “[We’re] really excited about getting in the U.S. market, and the reception that we're getting and the orders that we have.”

Medtronic announced in December that Hugo gained clearance for U.S. market access. Hugo received Europe’s CE mark in 2021, and is available in more than 35 countries.

Medtronic hopes the system can take share away from long-time market leader Intuitive Surgical in the soft tissue robotics space. There are several companies looking to challenge Intuitive; however, Medtronic and Johnson & Johnson — which submitted its Ottava system to the FDA in early January — are the largest contenders. Medtronic and J&J have more resources than smaller companies, as well as existing surgical businesses and strong connections with hospitals and surgeons.

While Hugo is kicking off in the U.S., Wall Street has questioned whether the system can be a meaningful competitor to Intuitive because of its sole urology indication and the advancements Intuitive has made with its da Vinci robot. UBS analyst Danielle Antalffy told MedTech Dive that while hospitals and academic centers will likely want a Hugo system, “I think it’s a stretch to think that Hugo is going to get much traction in the U.S.”

Medtronic said it plans to expand Hugo’s indications into gynecologic and general surgery procedures, including hernia repair.

PFA growth

Medtronic announced the Hugo news alongside earnings results for the third quarter of its fiscal year 2026, which began in April 2025. The company reported total sales of $9.02 billion, generating year-over-year growth of 8.7%.

Medtronic continues to grow its cardiac ablation solutions business, or CAS, fueled by sales and procedure growth for pulsed field ablation systems. CAS revenue grew by more than 80% worldwide year over year, including 137% in the U.S. The company is looking to keep up amid intense competition in the PFA market.

“Our PFA trajectory is strong, and we're progressing on multiple billion dollar opportunities,” Martha said.

Overall, Medtronic’s cardiovascular business brought in revenue of $3.46 billion in the quarter, representing growth of nearly 14% over the year-ago period.