Dive Brief:

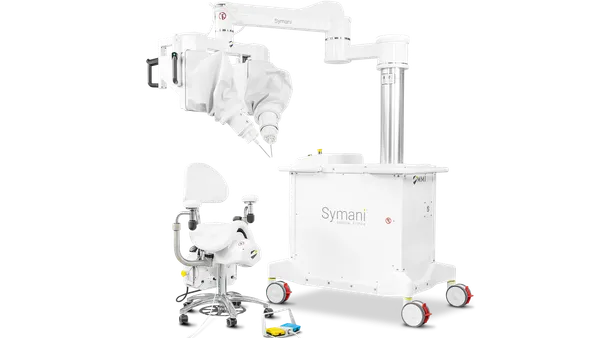

- Medtronic shared three-year data on Sunday for its renal denervation device, Symplicity Spyral.

- The company linked the product to significant reductions in two measures of systolic blood pressure.

- Researchers published the results in the wake of a consultation about Medicare coverage of RDN, which Medtronic said could drive growth.

Dive Insight:

The SPYRAL HTN-ON MED trial missed its primary endpoint in 2022, but Medtronic has subsequently shared cuts of the data that suggest RDN lowers blood pressure. The company presented the final report from the study at the 2025 Transcatheter Cardiovascular Therapeutics conference.

Three years after treatment, 24-hour ambulatory systolic blood pressure was down 14.0 mmHg in the RDN cohort versus a 9.3 mmHg reduction in the sham group. Office-based systolic blood pressure fell 18.5 mmHg in the RDN group compared to a 11.7 mmHg decline in the sham arm.

The gap between the RDN and control groups narrowed between the second and third years of the trial. Medtronic reported a 5.7 mmHg improvement in the 24-hour result after two years, compared to a 4.7 mmHg benefit after three years. The sham-adjusted improvements in the office-based result were 8.7 mmHg after two years and 7.4 mmHg after three years.

While the gap narrowed, patients who underwent RDN still had significantly lower blood pressure than people who received a sham treatment after three years. RDN achieved persistent benefits over sham treatment despite patients in the two cohorts taking similar medications.

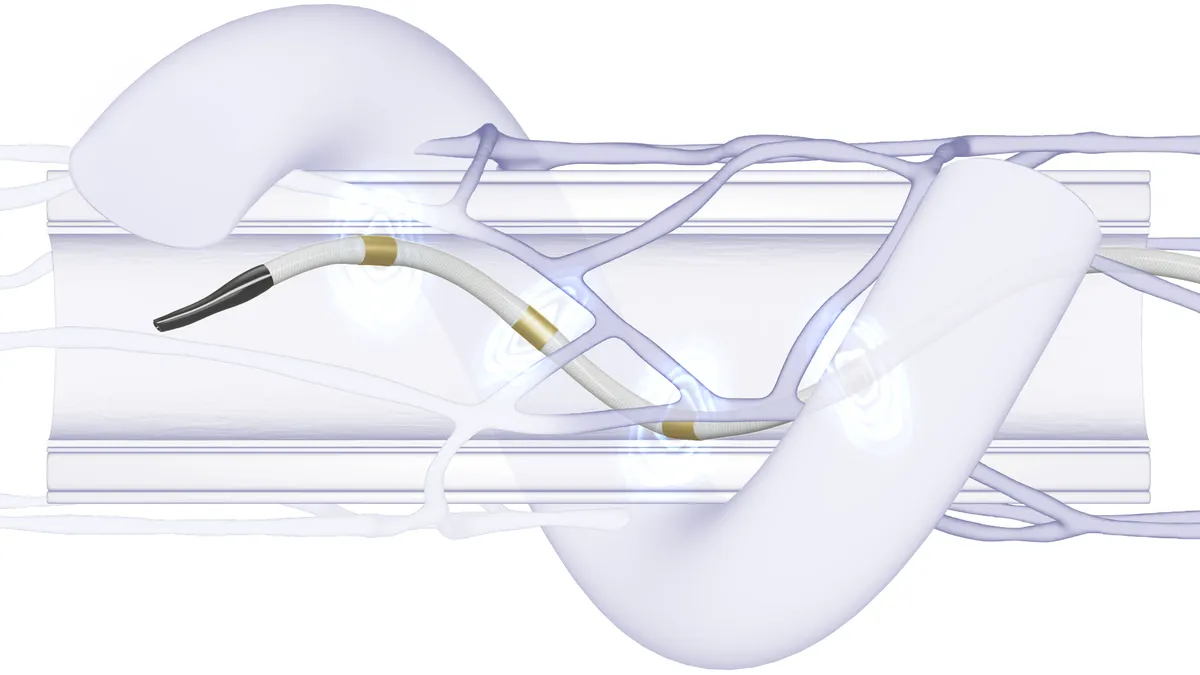

Medtronic said no patients in the RDN group had renal artery stenosis greater than 70%. Renal artery stenosis is a narrowing of arteries that supply blood to the kidneys. Symplicity Spyral is contraindicated in patients with renal artery diameter stenosis of more than 50% at baseline. Medtronic said the lack of new cases in the trial support the long-term safety of Symplicity Spyral.

The Food and Drug Administration approved Symplicity Spyral two years ago, setting up a competition between Medtronic and Otsuka’s Recor Medical for the RDN market. The Centers for Medicare and Medicaid Services proposed a national coverage determination for RDN in July.

Cardiologists voiced support for Medicare coverage of RDN. A final coverage determination was due by Oct. 8. However, amid a shutdown of the U.S. government, the CMS has not updated its coverage development process page since it added public comments in August.

Medtronic CFO Thierry Piéton discussed the impact of a potential Medicare coverage on an earnings call in August. Piéton predicted that RDN procedures would ramp up after the final coverage determination. Medtronic was “rapidly hiring clinical specialists and market development and healthcare economics managers to drive the future growth,” the CFO said.