Orthopedics companies posted record robot sales in the first quarter, even as they plan new product launches in the second half of 2024.

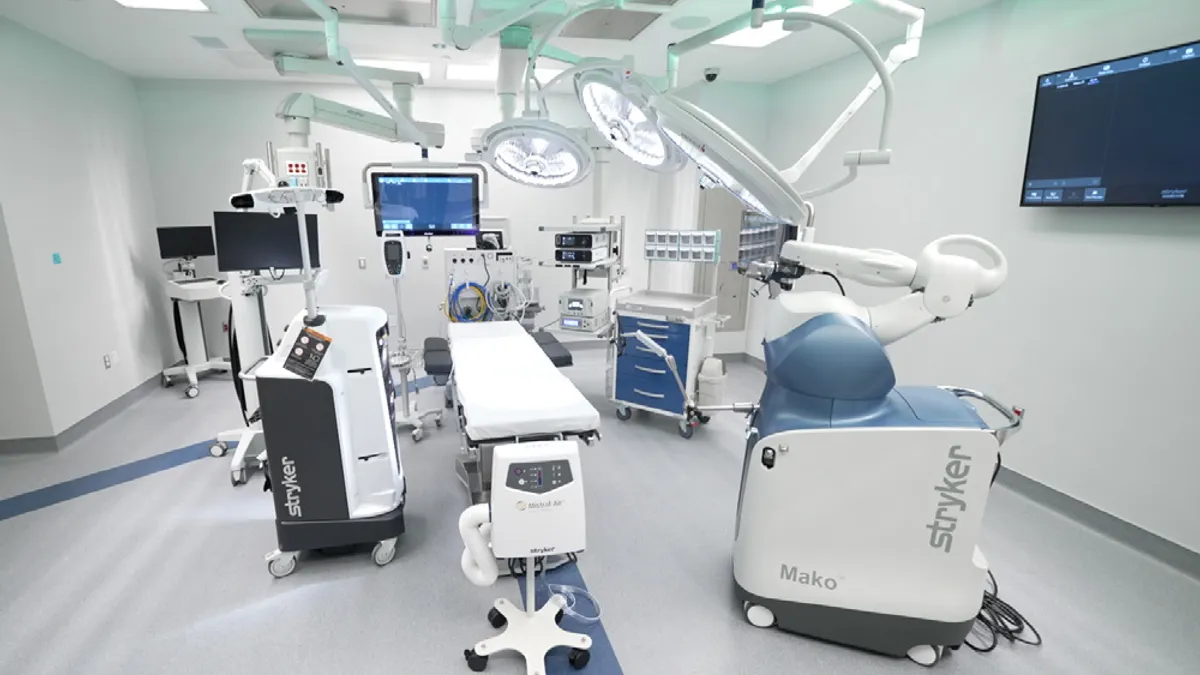

Stryker reported record installations of its Mako surgical robot in the first quarter, although it didn’t share an exact number. Jason Beach, Stryker’s vice president of finance and investor relations, said the company has seen “really good results” from direct-to-consumer ads promoting the surgical robot to people who might consider a hip or knee replacement.

CEO Kevin Lobo said Mako placements are also picking up outside of the U.S., including in India, which has the highest rate of robot utilization, Korea, and parts of Europe.

“That is a gift that will keep on giving,” he told investors in an April 30 earnings call.

The placements drove Stryker’s other orthopedics and spine segment to grow 41% year over year to $133 million.

Globus Medical also reported a busy quarter for robotic procedures, which grew 15% year over year. “This was our highest Q1 since launch,” CEO Dan Scavilla told investors on Tuesday, referring to the company’s enabling technology segment, which includes Globus’ Excelsius robotics and imaging platforms.

Scavilla also sees an opportunity to sell the company’s robots to Nuvasive customers, following Globus’ $3.1 billion acquisition of the spine specialist last year.

Zimmer Biomet had a strong quarter for sales of its Rosa robotic system, CEO Ivan Tornos said in a May 2 earnings call. He didn’t share the total number of placements, but said he was happy with the results, which drove the company’s “other” segment to increase by nearly 11% year over year to $157.3 million in sales.

Roughly a third of Zimmer’s U.S. robot installations are in ambulatory surgery centers (ASCs), Tornos said.

“Not a week goes by that there’s not a new ASC opening, and those ASCs do want to acquire robotics, and you either install or you purchase it,” he said. “We saw a dynamic in Q1 where we saw more purchases.”

Orthopedics companies' Q1 sales

New features

Orthopedics companies also used the earnings calls to highlight new robot features they plan to launch this year. In February, Zimmer received FDA clearance for a shoulder feature for its Rosa system. The company recently did its first cases at Mayo Clinic, Tornos said, adding that the company got “solid” feedback and the learning curve is “rather short.” He expects to ramp up sales slowly and see more of a financial impact close to the end of the year.

In March, BTIG analysts wrote that two orthopedic surgeons agreed the system was a “nice to have” and not a “need to have” at this point, and that there’s likely not enough value to justify purchasing a new robot for shoulder procedures alone.

Still, Tornos expects the feature to be a “very meaningful product launch for the company.”

Stryker shared an update on the company’s plans to launch a spine feature for its Mako robot in the fourth quarter, along with a feature called Copilot, which provides haptic feedback to help with discectomy and bone preparation. It also plans to launch a shoulder application at the end of the year.

Johnson & Johnson is also working on a spine feature and a partial knee feature for its Velys robot but didn’t share any updates on timing.

Finally, Globus plans to launch a reconstruction robot in the second half of 2024, which the company expects will ramp up implants of its knees and hips.

When asked about competitors’ planned launches of spine systems, CEO Scavilla said the company plans to stay focused on its technology and selling into a market with very low penetration.

Scavilla added that Globus has “always recognized the competition would someday come.”