Physician enthusiasm for new pulsed field ablation systems suggests the treatment will be rapidly adopted, to the benefit of device makers bringing the products to market, said analysts who attended the Heart Rhythm Society’s (HRS) annual meeting over the weekend.

Talk about pulsed field ablation (PFA), a catheter-based cardiac ablation technique to treat atrial fibrillation (AFib), dominated the meeting in Boston.

“The amount of data and discussions on pulsed field ablation (PFA) was almost overwhelming, with late-breaking data presentations packed by physicians,” Citi Research analyst Joanne Wuensch said in a report to clients Sunday.

Late-breaking study data on PFA devices from Johnson & Johnson and Medtronic and a subset analysis from Boston Scientific’s Advent trial largely validate the safety and effectiveness of the procedure, Truist Securities analyst Richard Newitter said in a Monday report.

Feedback from electrophysiologists points to a very steep adoption curve “right out of the gate,” Newitter said, estimating 50% to 70% of those doctors would convert cases to the procedure initially.

“Initial excitement around PFA among [U.S.] doctors is robust and PFA utilization is ramping aggressively,” Newitter wrote.

The analyst predicted Boston Scientific would see the biggest first-mover advantage in the U.S. market for PFA, “soon to be followed” by Medtronic.

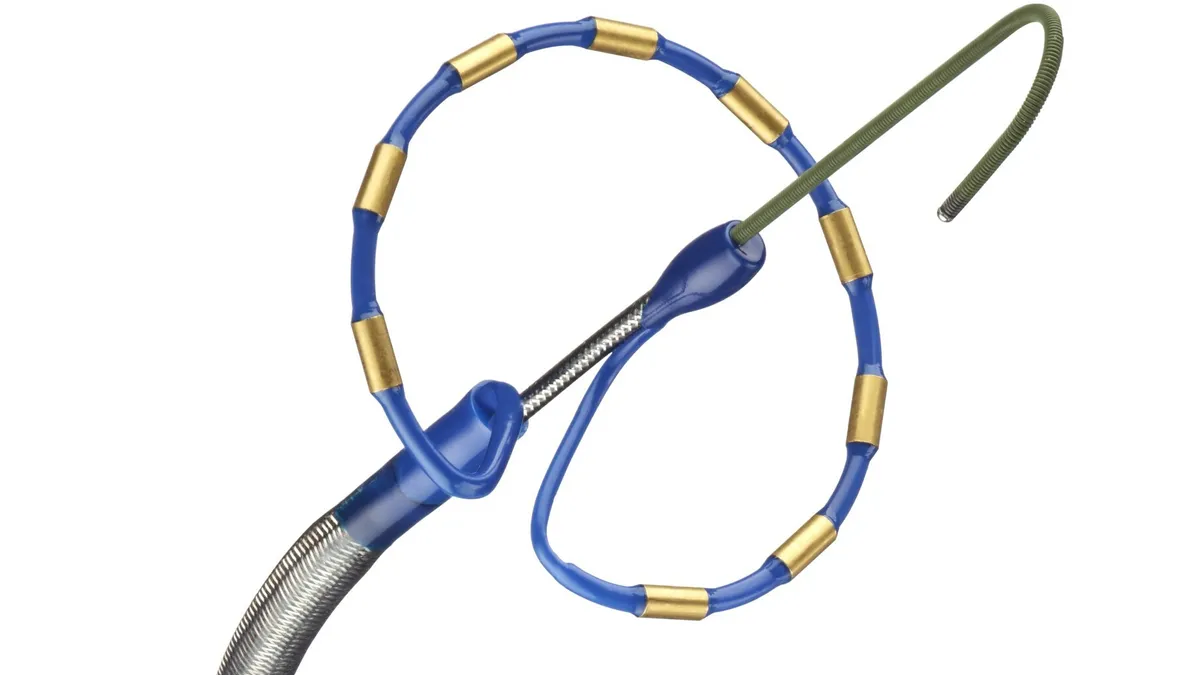

Boston Scientific received Food and Drug Administration approval for the Farapulse PFA device in January, while Medtronic gained U.S. approval for its PulseSelect system in December. J&J recently filed an FDA submission for its Varipulse platform, and Abbott is also developing a device called Volt.

PFA is seen as a potentially safer alternative to traditional radiofrequency and cryoablation to treat AFib, the most common form of irregular heart rhythm. Shorter operating times are viewed as another advantage.

Antiarrhythmic drugs are currently recommended as the first treatment for AFib but are associated with adverse events, according to the HRS. PFA differs from thermal ablation to disable cardiac cells by using electricity instead of heat or extreme cold.

“Recent technological advancements, such as catheter design and energy delivery, can pave the way for the wider adoption of PFA in clinical practice to improve patient outcomes,” the HRS said.

The PFA promise of safer and faster procedures was repeatedly reaffirmed during the HRS meeting, said Stifel analyst Rick Wise.

“At HRS, both physician and company commentary made it clear that pulsed field ablation (PFA) uptake is happening even more rapidly than expected,” Wise wrote to clients on Sunday.

The analyst added that PFA adoption in the U.S. is occurring much faster than in Europe due to “intense” demand from physicians and less sensitivity to pricing.

PFA’s takeover of the HRS conference comes as top medtech companies launch devices in the U.S. Next steps for the market are the FDA’s upcoming decision on J&J’s Varipulse system and how quickly Abbott can get a device to U.S. regulatory review.