Stryker expects a $200 million hit to its 2025 earnings from tariffs, the latest medical device company to call out impacts of hundreds of millions of dollars.

CFO Preston Wells told investors Thursday that the estimate is based on tariffs that are currently in effect. It does not include the impact of tariffs that were paused for 90 days.

Currently, imports from China face 145% tariffs, imports from Canada and Mexico that do not comply with the US-Mexico-Canada Agreement face 25% tariffs, and most imports are subject to a 10% baseline tariff. Last month, the Trump administration paused plans for other country-specific tariffs for 90 days.

Wells said the company expects to offset tariffs costs with sales momentum, pricing, optimizing the company’s supply chain and better-than-expected foreign currency impacts. Stryker raised its organic sales forecast by half a percentage point to a range of 8.5% to 9.5%. The company lowered its expectations for adjusted net earnings per share by 25 cents to a range of $13.20 to $13.45.

When asked on the earnings call how he would manage the business if tariffs decrease in the future, CEO Kevin Lobo said the company would raise its bottom line.

“We would have raised our earnings without question, had the tariffs not appeared at this time,” Lobo said.

Wells declined to specify where the tariff impact was coming from in response to an analyst’s question, but noted that 2% of Stryker’s business is in China. He also declined to provide a forecast for 2026, given “how quickly this has all changed and continues to change.”

Wells said the company does not have plans for major changes to its manufacturing footprint in the long term. Stryker is looking at dual sourcing to help offset tariffs for certain products.

“In our industry, of course, it's very difficult to move a manufacturer, and it takes a long time to do so,” Wells said.

Product updates

Stryker’s leaders fielded other questions about upcoming products, procedure rates and demand for capital equipment with a potential recession looming.

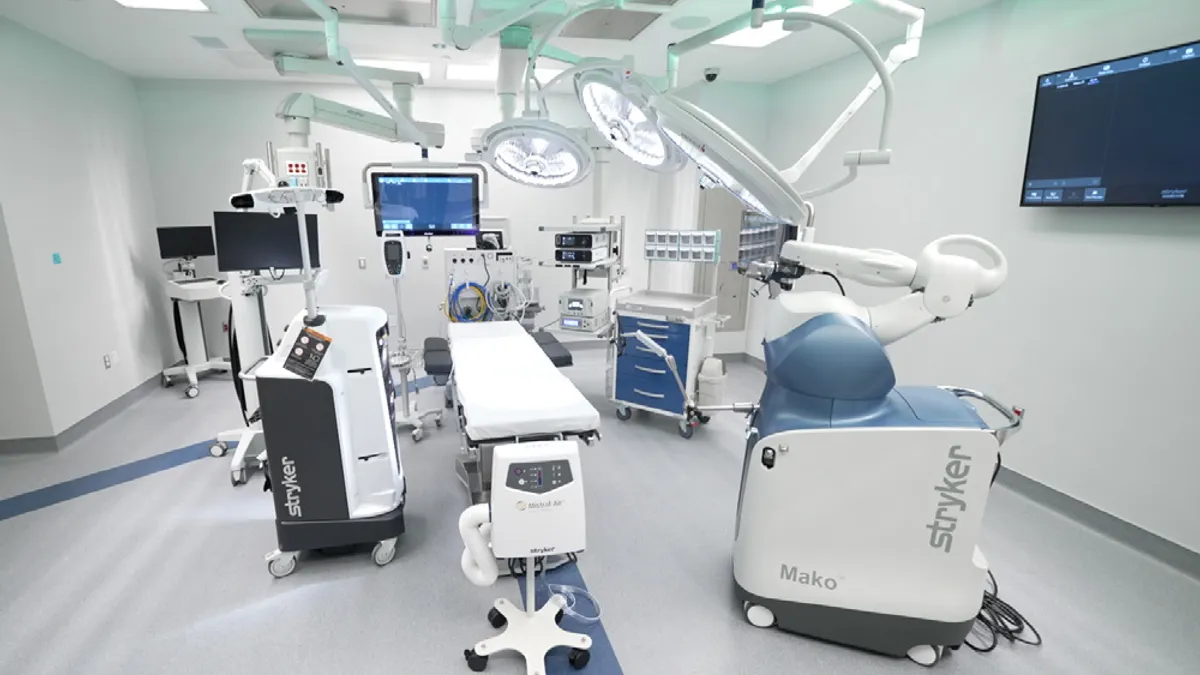

Stryker recently launched the newest version of its orthopedic robot, Mako 4. The company had record installations of the robot in the first quarter, said Jason Beach, vice president of finance and investor relations.

Beach reaffirmed that the company is on track for a full U.S. commercial launch of a spine feature for Mako in the second half of the year and a shoulder feature in the first quarter of 2026. The shoulder feature is currently in a limited release.

Lobo said he expects Mako shoulder to be a meaningful contributor to sales next year, predicting the feature would be used by surgeons with a Mako robot for hip and knee procedures who perform a smaller number of shoulder surgeries.

Lobo also fielded questions about whether a potential recession could slow hospital demand for capital equipment. The CEO said Stryker has so far not seen any signs of a slowdown.

“Our order book is really elevated,” Lobo said. “Our backlog is as high as it’s ever been.”

He expects demand for small capital equipment should persist, even in a recession, because hospitals still need to conduct procedures, and people don’t tend to cancel orthopedic surgeries once scheduled.