Dive Brief:

- Stryker on Tuesday posted first-quarter earnings shy of Wall Street forecasts, as costs related to the orthopaedic device maker's $4 billion acquisition of Wright Medical last year ate into profits.

- But net sales, up 10.2% from a year ago to $3.95 billion, were in line with analysts' forecasts. Executives said growth in its U.S. hip and knee businesses accelerated in March and into April, after declining in January and February, and orders for capital products including the Mako surgical robot are picking up.

- The Kalamazoo, Mich.-based medtech also raised its full-year earnings outlook. "Underlying some of these assumptions is that Q2 has a return to normalcy by the time we get to the end, and then we'll continue to see great growth in Q3 and Q4," CFO Glenn Boehnlein said on the earnings call.

Dive Insight:

Orthopaedic surgery was among the hardest hit specialties during the pandemic as patients and hospitals postponed non-emergency procedures. In 2020, the medtech sector saw procedure volumes retreat in March and April, then recover into the summer and fall, only to pull back again in November and December as COVID-19 cases surged again. Stryker's hip sales declined 12.8% in 2020 and its knee sales fell 13.7%, compared to the year before.

As 2021 began on an uncertain note, feedback from 200 U.S. surgeons in a UBS poll conducted in February and March suggested orthopaedic procedure volumes would improve throughout the year but still hover below 2019 levels, only exceeding pre-pandemic demand in 2022. The surgeons expected Stryker to gain share in the hip and knee markets.

First-quarter earnings reports out this month from medtech companies have struck a more upbeat tone on the outlook for elective procedures. Stryker rival Johnson & Johnson said it saw orthopaedic procedures begin to bounce back in the quarter.

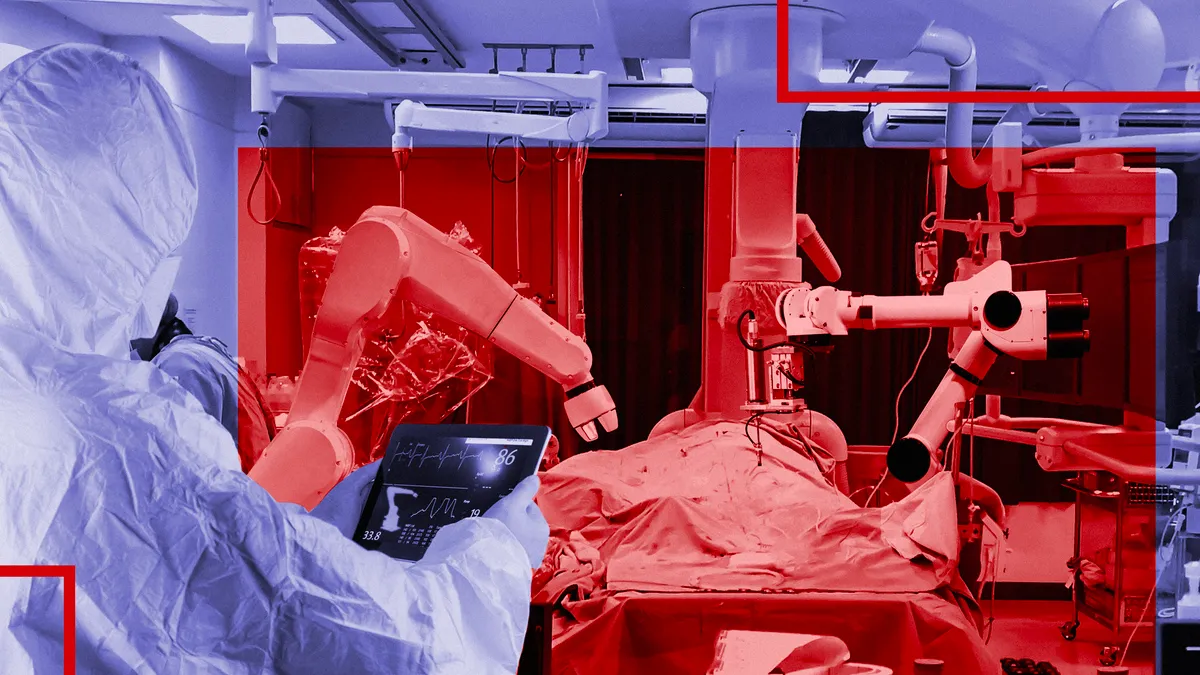

Stryker CEO Kevin Lobo said on the earnings call Tuesday that the company's Mako surgical robot, neurovascular and medical products businesses posted strong double-digit growth in the first quarter, compared to 2019, and the momentum is expected to continue through the rest of the year. The slowdown in elective procedures at the start of the year had the biggest impact on the company's hip and knee businesses, he said, but growth recovered to the mid-single-digits in March and April.

The trauma and extremities business, including Wright Medical, grew 2.6%, compared to 2019. Stryker forecast mid-single-digit growth in the business for the full year, compared to 2019, and said the integration of Wright was proceeding faster than expected.

The company's order book also has picked up across its capital businesses, signaling future growth in device implants as procedure volumes return to more normal levels, Lobo said.

Analysts at BTIG, in a note to clients, said the capital orders strength points to a recovery in orthopaedic procedures in the second half of the year. "Needless to say, Mako remains in early innings (outside the U.S.) with significant runway for growth, and robust placements further point to solid future demand for implants," they wrote.

Jefferies analysts estimated Mako's installed base at more than 1,200 systems, putting it ahead of the 300-plus Zimmer Rosa systems in the field and less than 200 for Smith & Nephew's robots. But the race could tighten as Rosa gains momentum and J&J enters the market with a system of its own, the analysts said in a report after Stryker's earnings release.

The new 2021 forecast predicts a range of $9.05 to $9.30 per share, on an unchanged revenue growth forecast of up 8% to 10% from 2019.