Zimmer Biomet expects a $60 million to $80 million impact to its operating profit from tariffs this year, CFO Suketu Upadhyay told investors Monday.

That estimate accounts for “current administration proposals,” Upadhyay said, including announced European reciprocal tariffs going into effect after a 90-day stay. Most of the impact is expected in the second half of the year.

Zimmer’s stock fell by more than 11% on Monday, as analysts called out uncertainty about tariffs and lost market share in the company’s knees segment.

J.P. Morgan analyst Robbie Marcus wrote in a research note that the tariff impact looks “manageable at face value, but we have more questions than answers on the size of the full-year impact in 2026.”

BTIG analyst Ryan Zimmerman added that the 2026 impact remains an “open-ended question,” and the orthopedics company’s inventory levels suggest that tariffs will show up more meaningfully next year.

Zimmer lowered its adjusted earnings per share forecast by 25 cents to a range of $7.90 to $8.10 for 2025. The forecast factors in the tariffs and the $1.1 billion purchase of Paragon 28, a company specializing in foot and ankle implants, which closed in April.

At the same time, the company raised its revenue growth forecast for the year to a range of 5.7% to 8.2%, accounting for foreign currency rates and the Paragon acquisition.

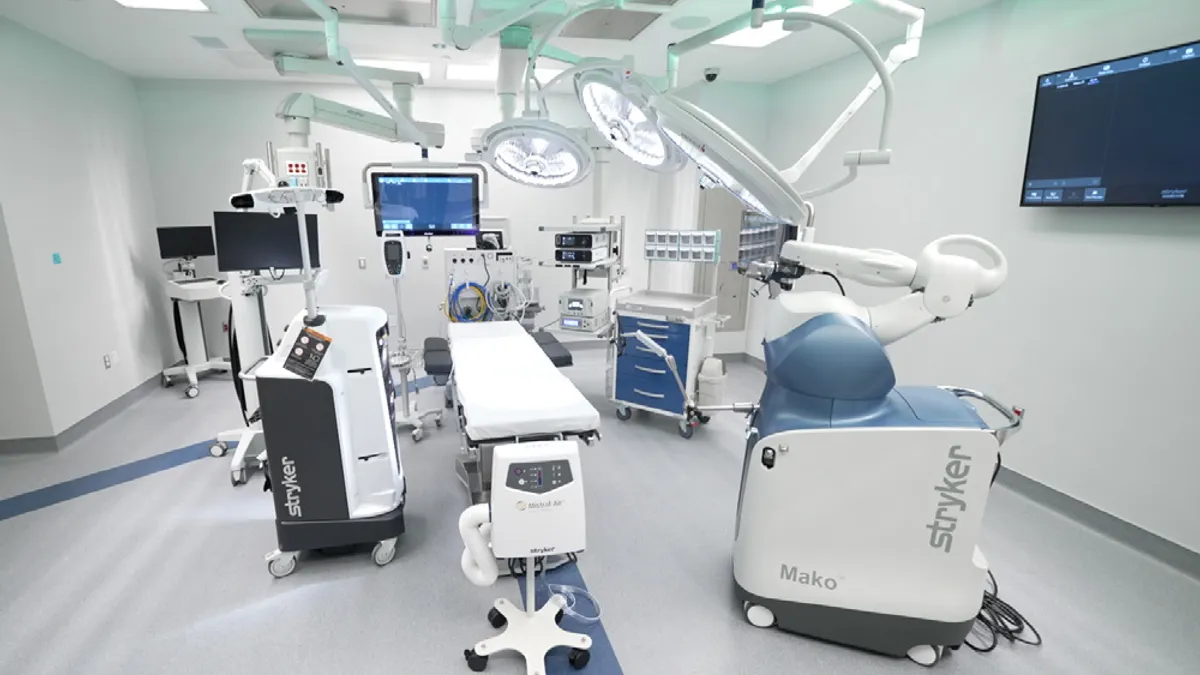

Zimmer forecast a smaller hit from tariffs than other medtech peers, which have set out estimates in the hundreds of millions of dollars. For example, competitor Stryker called out a $200 million impact from tariffs, and lowered its earning per share forecast.

When asked about this, Upadhyay said the majority of Zimmer’s devices are produced in the U.S. Still, the company is taking some early steps to mitigate the impact, including optimizing country of origin, using dual sourcing or redundant sourcing when possible, and spending less in areas that don’t affect the company’s long-term growth, the CFO added.

Lost share in knees

Zimmer reported $792.9 million in sales from its knees business in the first quarter, a 0.6% increase year over year. Meanwhile, competitor Stryker, which reported sales of $639 million in knees, grew at a faster rate of 8.7%.

BTIG analyst Shagun Singh wrote in a research note that Zimmer Biomet lost market share in its U.S. knees business in the first quarter.

“I don't think the robot is the main reason why we are behind when it comes to knee performance in the U.S.,” CEO Ivan Tornos told investors. “It has to do with the fact that we have the largest share and the fact that we have got to do better when it comes to commercial execution, and we're going to improve upon that.”

Tornos expects the company’s U.S. knees business to perform better in the second quarter. He called out cementless knee products, including a cementless partial knee implant that Zimmer received FDA approval for in November, as driving growth in 2025. The CEO said Zimmer has passed 25% market penetration with cementless knees.

The company has filed a 510(k) submission for a new version of its knee platform for its Rosa surgical robot. It also has plans to add a CT scan capability and another partial knee platform to Rosa.