M&A: Page 4

-

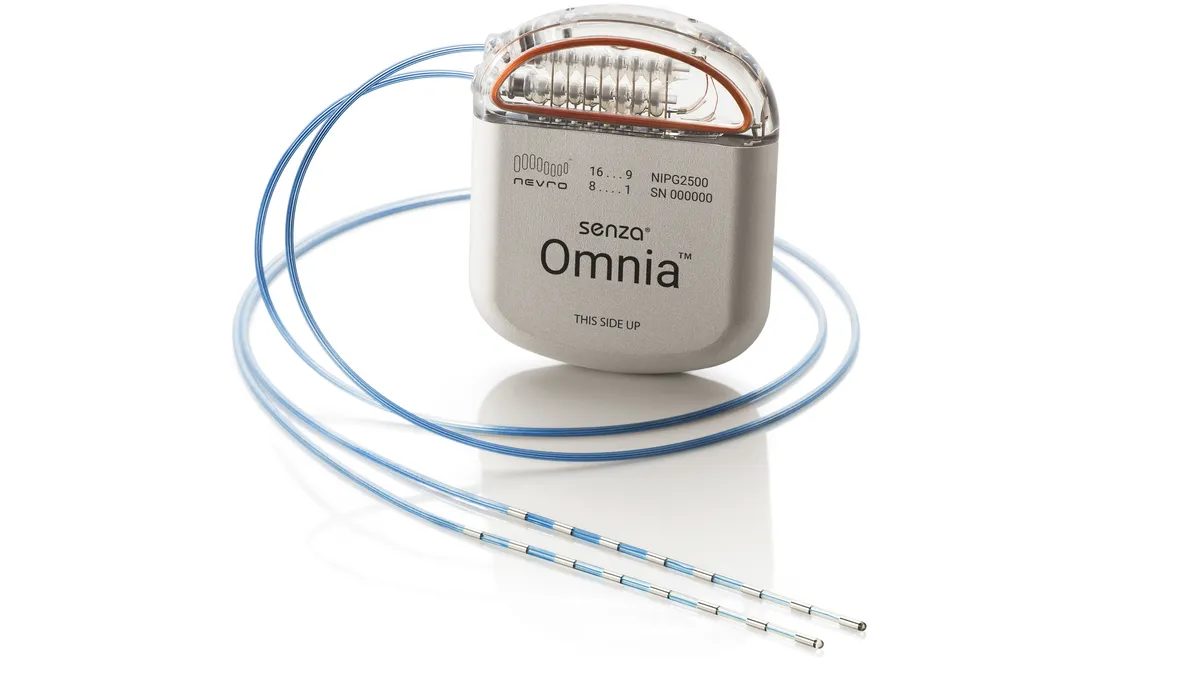

Globus to buy Nevro for $250M

Analysts said Nevro’s valuation was “inexpensive,” but the spinal cord stimulation business can benefit from Globus’ scale and orthopedic relationships.

By Elise Reuter • Feb. 6, 2025 -

Zimmer touts ASC opportunity with Paragon 28 purchase

With the $1.1 billion acquisition, Zimmer Biomet expects its sports medicine, extremities and trauma segment will outpace hips and knees.

By Elise Reuter • Feb. 6, 2025 -

2025 outlook

Top medtech trends in 2025: New products and M&A are bright spots, but Trump brings uncertainty

Experts highlighted surgical robotics, artificial intelligence and M&A as top trends this year. However, the Trump administration could create challenges for the industry.

By Ricky Zipp • Jan. 31, 2025 -

Zimmer to buy Paragon 28 for $1.1B

Needham analysts, who were surprised by the bargain for Paragon 28, said Zimmer may not be done spending.

By Ricky Zipp • Jan. 29, 2025 -

Stryker to sell spinal implants business

The company named a new CFO and shared an update on its planned Inari Medical acquisition.

By Elise Reuter • Jan. 29, 2025 -

Philips to sell emergency care business

Investment firm Bridgefield Capital will buy the segment, which includes cardiac resuscitation and emergency care devices, for an undisclosed amount.

By Elise Reuter • Jan. 28, 2025 -

Intuitive inks deals to sell robots in Italy, Spain and Portugal

Intuitive is buying businesses that distribute its da Vinci and Ion surgical robots to establish a direct presence in Italy, Spain, Portugal, Malta and San Marino.

By Nick Paul Taylor • Jan. 23, 2025 -

Medtronic inks distribution deal with Contego with option to buy firm

Medtronic will be the exclusive U.S. distributor of Contego Medical’s portfolio, which includes a carotid stent system and thrombectomy devices.

By Ricky Zipp • Jan. 13, 2025 -

Deep Dive // 2025 outlook

5 medtech trends to watch in 2025

After a busy 2024, experts called out competition in soft tissue robotics, uncertainty from a Trump White House and continued success for pulsed field ablation as trends to watch this year.

By Ricky Zipp • Jan. 9, 2025 -

Boston Scientific to buy remaining Bolt Medical stake for up to $664M

The deal for Bolt, developer of an intravascular lithotripsy system to treat coronary and peripheral artery disease, continues Boston Scientific’s brisk run of acquisitions.

By Susan Kelly • Jan. 8, 2025 -

Retrieved from Stryker Corporation on January 06, 2025

Retrieved from Stryker Corporation on January 06, 2025

Stryker to buy Inari Medical for nearly $5B

Stryker made several small deals in 2024 but lacked a larger acquisition like its nearly $5 billion proposal for Inari Medical.

By Ricky Zipp • Jan. 6, 2025 -

Top 10 medtech deals of 2024

Multibillion-dollar buyouts returned last year, led by Johnson & Johnson’s $13.1 billion acquisition of Shockwave Medical.

By Nick Paul Taylor • Jan. 2, 2025 -

Labcorp closes takeover of Ballad Health outreach laboratory services

Labcorp continued its streak of hospital lab purchases with a deal that will expand its testing capabilities to communities in Tennessee, Virginia, North Carolina and Kentucky.

By Nick Paul Taylor • Dec. 12, 2024 -

Patterson, a dental products distributor, agrees to $4.1B sale to healthcare investor

Last week, Patterson Companies announced it would seek strategic alternatives after the company’s profit decreased by one-third in its fiscal second quarter.

By Elise Reuter • Dec. 11, 2024 -

How Trump’s second term will affect the medtech industry

From M&A and tariffs to new health leaders, here are the top issues for the medtech industry to watch during President Donald Trump’s return to office.

By Ricky Zipp • Dec. 10, 2024 -

Haemonetics to offload whole-blood business for up to $67M

Selling the assets to Italy’s GVS should help Haemonetics improve its revenue growth and profit margins, analysts said.

By Susan Kelly • Dec. 4, 2024 -

GE Healthcare to buy radiopharmaceutical firm Nihon Medi-Physics

GE Healthcare has identified radiopharmaceuticals as a growth driver for the company and Japan as a key market.

By Elise Reuter • Dec. 3, 2024 -

Boston Scientific to buy Intera Oncology, maker of liver cancer treatment

Intera makes a pump and a chemotherapy drug to treat liver tumors. Boston Scientific sees the purchase as a way to provide more comprehensive cancer treatments.

By Elise Reuter • Nov. 25, 2024 -

Medtronic buys surgical instrument developer Fortimedix

Fortimedix develops flexible surgical instruments that are responsive enough to navigate the body and enable endoscopic and minimally invasive procedures.

By Nick Paul Taylor • Nov. 22, 2024 -

Henry Schein to acquire medical supplier Acentus

Acentus, which specializes in supplying glucose sensors to patients’ homes, continues Henry Schein’s recent focus on building its homecare medical supplies business.

By Ricky Zipp • Nov. 21, 2024 -

Boston Scientific closes $3.7B Axonics deal after lengthy review

Boston Scientific announced the acquisition in January, but the review dragged on after the Federal Trade Commission requested more information.

By Ricky Zipp • Nov. 15, 2024 -

Tempus AI to buy genetic testing company for $600M

CEO Eric Lefkofsky said the purchase of Ambry Genetics will expand Tempus’ testing portfolio and bring in a fast-growing business.

By Elise Reuter • Nov. 6, 2024 -

Boston Scientific continues M&A run with Cortex buy

Cortex adds to Boston Scientific’s electrophysiology portfolio amid treatment shifts in the space driven by new pulsed field ablation devices.

By Ricky Zipp • Nov. 4, 2024 -

Boston Scientific to close Silk Road Medical headquarters, lay off 138 people

Following its acquisition of Silk Road in September, Boston Scientific said it plans to consolidate the company’s work in Minnesota.

By Elise Reuter • Oct. 28, 2024 -

The Medtech Conference

That’s a wrap: 5 takeaways from The Medtech Conference

The conference — Advamed’s largest — featured an appearance by the device center’s new acting director and sessions on AI, clinical trial diversity and the FDA’s contentious LDT rule.

By Elise Reuter • Oct. 22, 2024