Dive Brief:

- Digital therapeutics company Pear Therapeutics is “exploring strategic alternatives” to maximize shareholder value, the company said in a regulatory filing on Friday.

- The firm is considering a potential acquisition, company sale, merger, divestiture of assets, licensing, other strategic transaction or seeking additional financing, with no set timetable.

- If the company isn’t able to complete a transaction, it said “it may be required to seek a reorganization, liquidation or other restructuring.”

Dive Insight:

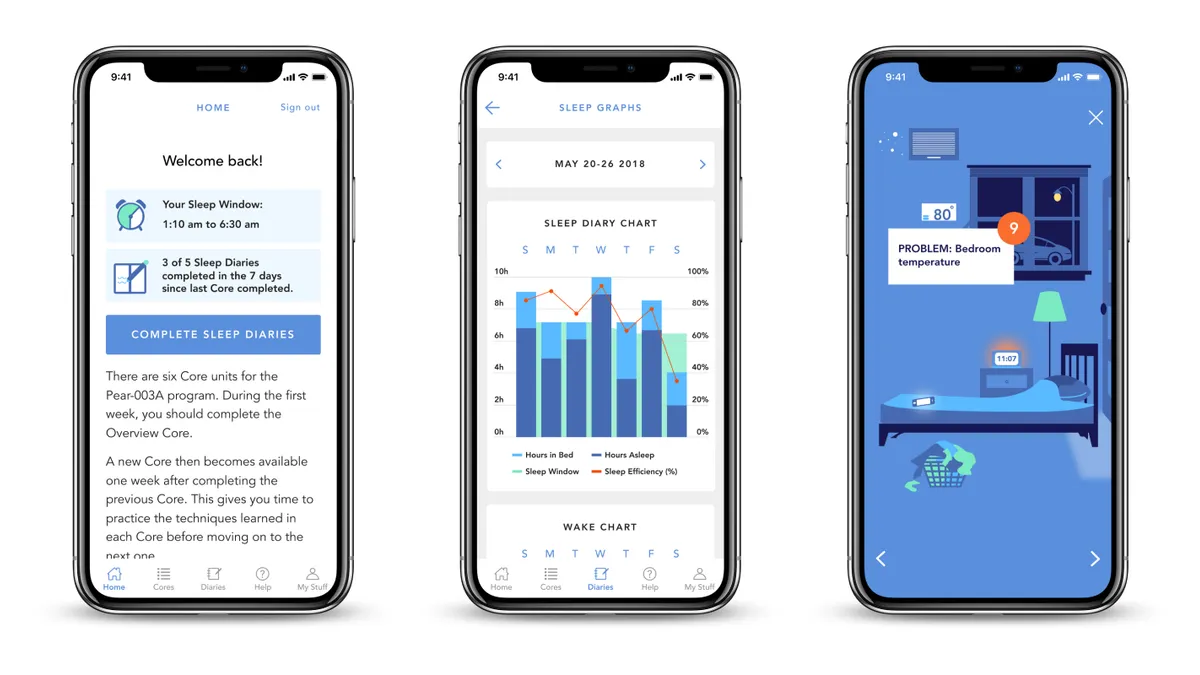

Boston-based Pear currently has three prescription digital therapeutics on the market: app-based treatments for insomnia, substance use disorder and opioid use disorder. While the company has succeeded in running studies to prove the efficacy of these apps and in getting clearance from the Food and Drug Administration, reimbursement for this new type of treatment has posed more of a challenge.

So far, Pear has largely worked with state Medicaid agencies to cover its app-based programs, but lowered its revenue forecasts for 2022 to $14 million to $16 million, citing slow progress with commercial and government payers. The company had two rounds of layoffs last year, starting with a July restructuring in which Pear sought to save money by focusing on selling its existing FDA-cleared treatments and cutting down on development of new products. In November, it trimmed more than a fifth of its staff to extend its cash runway.

The company has not yet reported its fourth-quarter 2022 earnings results.

“There is no set timetable for this process and there can be no assurance that this process will result in the Company pursuing a transaction or that any transaction, if pursued, will be completed on attractive terms,” Pear said in the filing with the Securities and Exchange Commission. It added that it does not plan to make any further announcements until it “determines that other disclosure is necessary or appropriate.”

Pear has hired MTS Health Partners, a boutique investment bank, as a financial adviser to help evaluate potential alternatives. Shares of the company fell 16% on Friday to $0.50.