Dive Brief:

- Samsung has signed an agreement to acquire digital health company Xealth, the South Korean electronics giant said Tuesday.

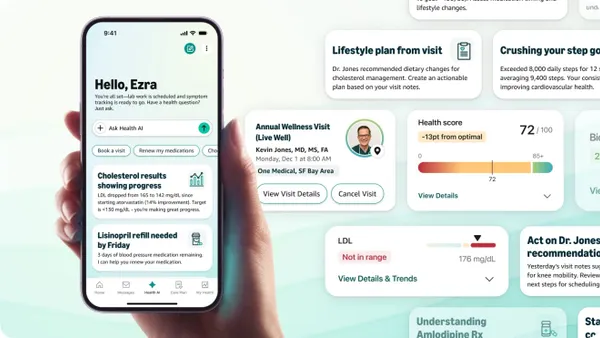

- The purchase of Xealth, which offers a platform that helps providers manage digital tools, bolsters Samsung’s goal to “unify fragmented health information” and ensure data from wearables — like Samsung’s Galaxy Watch line — is integrated into clinical care, the company said in a press release.

- The acquisition is expected to close this year. Financial terms of the deal weren’t disclosed.

Dive Insight:

Xealth, which was spun out of Washington-based health system Providence in 2017, allows providers to access and manage multiple digital health products through their electronic health record and centralize remote patient monitoring programs.

The company works with more than 500 U.S. hospitals, including Advocate Health, Banner Health and the Cleveland Clinic, and more than 70 digital health firms, according to a press release.

The Xealth purchase should help ensure data from consumer wellness products can be shared more easily with providers, Samsung said.

“Customer health data from wearables can fill in context that is missing to hospitals and bring more data analysis possibilities that were not available just with clinical records,” Mike McSherry, Xealth CEO, said in a statement. “Together with Samsung and our network of healthcare leaders, we will design a bridge between home health monitoring and clinical decision-making, with provider workflow considerations and patient engagement at the core of that effort.”

Meanwhile, Samsung already has a presence in healthcare technology. The electronics firm’s Galaxy Watch wearable has received clearance from the Food and Drug Administration to detect irregular heart rhythms and signs of sleep apnea.

Earlier this summer, the company said it planned to develop a data hub to help users share health information with their doctors.

The deal to acquire Xealth comes as exit opportunities for digital health companies look more promising. Two firms, digital musculoskeletal firm Hinge Health and chronic condition management company Omada Health, completed initial public offerings in recent months after a yearslong IPO dry spell for the sector.

But mergers and acquisitions are still more common exit routes for digital health companies — and M&A is on the rise this year, according to a report published this week by venture capital firm and consultancy Rock Health.

The report tracked 107 digital health M&A deals in the first half of the year, on track to outpace the 121 transactions recorded in 2024.