Dive Brief:

- Synchron has raised $200 million to support commercialization of its brain computer interface platform, the company said Thursday.

- The Series D round will fund preparations to launch Synchron’s first-generation platform, which translates brain activity into digital commands without open-brain surgery, and development of a new interface.

- Synchron’s funding moves investment in BCI companies in 2024 and 2025 beyond $1 billion, with the round adding to financings at Blackrock Neurotech, Neuralink and Precision Neuroscience.

Dive Insight:

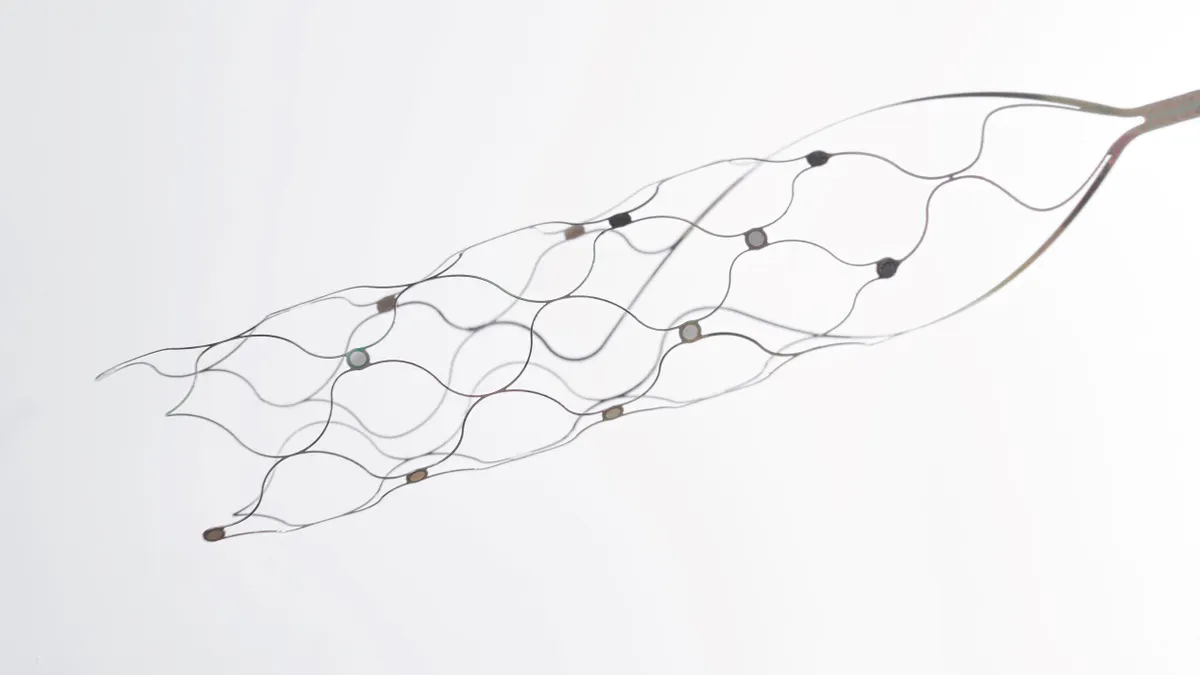

The BCI companies are developing devices that capture and interpret signals from the brain to trigger an action, such as hands-free control of digital devices. Yet the devices have significant differences. While Elon Musk’s Neuralink is developing a device that is implanted by removing part of the skull, Synchron’s first-generation product is placed via a catheter procedure.

Each device is a trade-off between the invasiveness of the procedure and the fidelity of the signal it can capture. Synchron’s first-generation Stentrode device has 16 electrodes, compared with 1,024 electrodes for Neuralink’s N1 Implant, but it can still enable severely paralyzed people to control personal devices.

The Series D round positions Synchron to try to capitalize on the benefits of its first-generation device while working to overcome the implant’s limitations in the longer term. Synchron will use some of the money to accelerate pivotal trials and prepare for commercial launch of the Stentrode BCI system. At the same time, Synchron will work on a next-generation, transcatheter high-channel whole-brain interface.

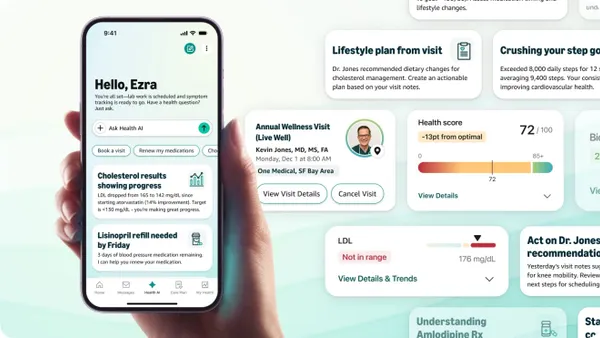

Artificial intelligence is part of Synchron’s strategy. The company is growing an AI team in New York City that is training models to learn from brain data. Synchron’s goal is to decode thought in real time. A new engineering hub in San Diego is working to build the company’s next brain interface. Synchron is hiring engineers, neuroscientists and operators to do the work.

Double Point Ventures led the Series D round. Existing investors ARCH Ventures, Khosla Ventures, Bezos Expeditions, NTI and METIS contributed to the financing, as did new backers including the Australian National Reconstruction Fund, T.Rx Capital, Qatar Investment Authority, K5 Global, Protocol Labs and IQT.