Dive Brief:

- Tempus AI has struck a deal to buy the digital pathology business Paige for $81.25 million, the companies said Friday.

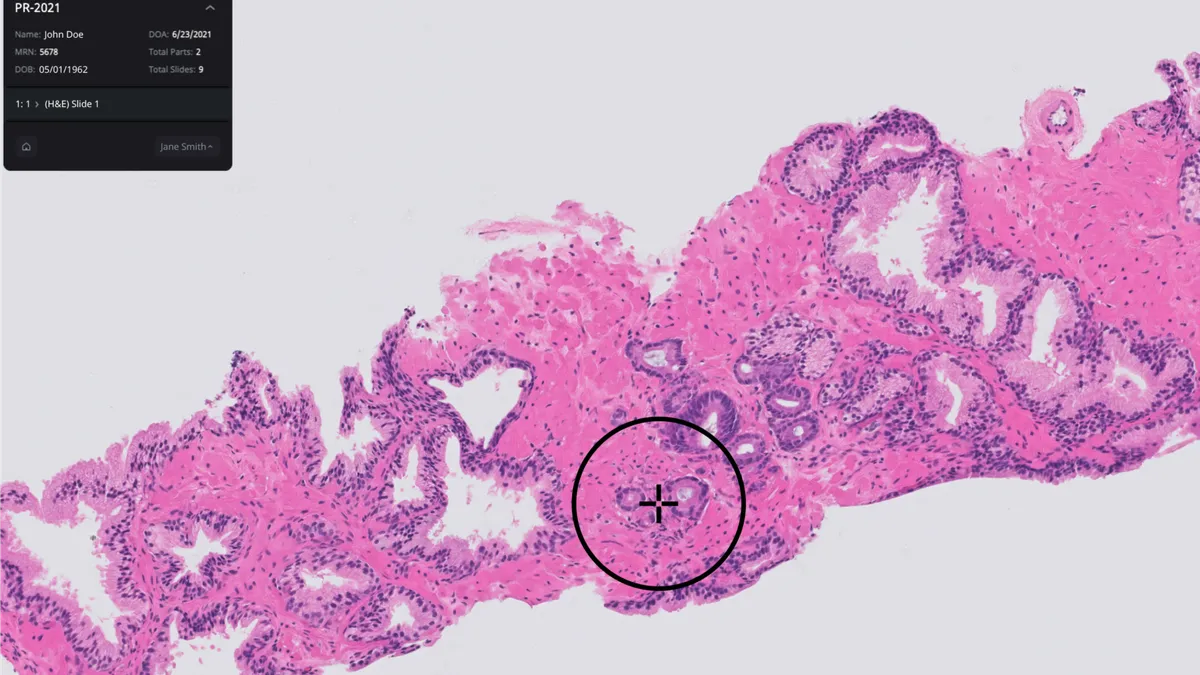

- The takeover will give Tempus control of almost 7 million digitized pathology slide images and associated clinical and molecular data to support development of its artificial intelligence model.

- Paige spun off from Memorial Sloan Kettering Cancer Center in 2017. Using the hospital’s digital slide archive, the company trained algorithms to flag potentially cancerous lesions in images.

Dive Insight:

By 2021, Paige had raised more than $220 million, received authorizations for software in Europe and the U.S. and landed deals with Philips and Quest Diagnostics. The company, which went on to partner with Microsoft, looked to build on the authorization of software for supporting the diagnosis of prostate cancer by developing AI tools for other tumor types. Paige continued to receive 510(k) clearances.

The company, which last disclosed a financing round in 2021, has accepted a buyout offer that is worth less than 40% of its publicly disclosed funding to date. Tempus will mostly pay for Paige in stock. The deal will also see Tempus assume Paige’s commitment under a Microsoft Azure cloud services agreement.

Tempus CEO Eric Lefkofsky said in a statement that buying Paige “substantially accelerates” his company’s effort to build the largest foundation model in oncology. Foundation models are AI neural networks trained on large datasets. The models provide a starting point for the development of AI tools that perform specific tasks.

Buying Paige gives Tempus more data to train its model. Paige has already developed a foundation model for cancer using 1 million slides. In total, the company has almost 7 million digitized pathology slides and associated data from 45 countries. The dataset spans genders, races, ethnicities and regions.

The takeover is aligned with the M&A plan that Lefkofsky outlined on an earnings call two weeks before disclosing the buyout. Lefkofsky said he is happy with Tempus’ diagnostic portfolio and, as such, might look to do deals that enhance the data or apps businesses. Within those areas, Lefkofsky said Tempus was prioritizing deals that would not derail the company’s plans to become profitable.

“We're not looking to move in a direction that would change our operating plan materially,” Lefkofsky said. “You should expect us to be disciplined in terms of what we acquire, you should expect it to be synergistic, plug some kind of hole within the company that we believe is strategic and important and not be some kind of crazy left turn that has us going backwards in massive ways.”

The deal comes about five months after Tempus bought clinical trial software company Deep 6 AI. Tempus paid $17.4 million for Deep 6, split between $4.3 million in cash and $13.1 million in stock. The company inked a bigger deal last year, paying $600 million to buy genetic testing company Ambry Genetics.