M&A: Page 2

-

Abbott to acquire Exact Sciences for about $21B

The purchase would give Abbott access to cancer screening tests including Cologuard and blood tests for multi-cancer early detection.

By Elise Reuter , Susan Kelly • Updated Nov. 20, 2025 -

Labcorp inks deal to buy Parkview Health outreach laboratory assets

The takeover extends a string of deals that have consolidated the outreach lab services market.

By Nick Paul Taylor • Nov. 14, 2025 -

Judge denies FTC’s bid to block $627M Surmodics buyout

The ruling removes a barrier to a deal the FTC claims will eliminate competition in the outsourced hydrophilic coatings market.

By Nick Paul Taylor • Nov. 12, 2025 -

Laborie inks $465M deal to buy post-childbirth device from Organon

Organon tripled sales of the bleeding-control system from 2022 to 2024 and is on track to grow sales again this year.

By Nick Paul Taylor • Nov. 10, 2025 -

Qiagen inks $225M single-cell buyout as CEO prepares to step down

Qiagen has identified Parse Biosciences’ technology as complementary to its sample technology and bioinformatic businesses.

By Nick Paul Taylor • Nov. 5, 2025 -

Thermo Fisher to acquire clinical trial data firm Clario for $8.9B

The purchase is expected to complement Thermo’s clinical research services as companies are conducting more trials.

By Elise Reuter • Oct. 29, 2025 -

Hologic to go private for up to $18.3B

Funds managed by Blackstone and TPG plan to acquire the medtech firm for up to $79 per share.

By Elise Reuter • Oct. 21, 2025 -

Boston Scientific to buy Nalu Medical for $533M

Nalu’s implantable neurostimulation system delivers electrical impulses to treat chronic pain originating from the peripheral nerves.

By Susan Kelly • Oct. 17, 2025 -

What J&J’s ortho spinoff means for the industry

Analysts expect that DePuy Synthes could become a stronger competitor as a standalone company.

By Elise Reuter • Oct. 16, 2025 -

J&J plans to spin out orthopedics business

CEO Joaquin Duato said the spinout will help the healthcare giant focus on medtech areas with higher growth and margins, such as cardiovascular and robotics.

By Ricky Zipp • Oct. 14, 2025 -

Owens & Minor inks $375M deal to sell unit to investment firm

The sale will leave Owens & Minor focused on a smaller but potentially faster-growing and higher-margin business that provides products directly to patients.

By Nick Paul Taylor • Oct. 8, 2025 -

Medtech M&A has remained slow this year. But 2 execs are ready to make a deal

Executives from Stryker and Johnson & Johnson are on the hunt for deals, despite a turbulent environment, they said at AdvaMed’s The MedTech Conference.

By Ricky Zipp • Oct. 8, 2025 -

Medtech firms splitting into ‘haves’ and ‘have-nots’: EY

The number of medtech funding rounds has declined in recent months, but the value of overall deals has increased, according to a new report from EY.

By Elise Reuter • Sept. 29, 2025 -

Biogen to buy startup Alcyone, eyeing easier delivery of RNA drugs

The purchase gives Biogen full access to an implantable device that could help patients avoid the repeat lumbar punctures required for drugs like Spinraza.

By Kristin Jensen • Sept. 19, 2025 -

B. Braun buys True Digital Surgery for microscopy technology

The acquisition gives B. Braun control of a company that provides technology for its Aeos robotic digital microscope.

By Nick Paul Taylor • Sept. 15, 2025 -

AI drives medtech investment in 2025

Medical device companies working with artificial intelligence raised funding and were acquisition targets in recent months.

By Elise Reuter • Sept. 12, 2025 -

GE HealthCare inks Icometrix buyout to acquire brain MRI software

The deal includes AI-powered software for detecting known side effects of recently launched Alzheimer’s drugs.

By Nick Paul Taylor • Sept. 11, 2025 -

Boston Scientific inks $88M Elutia deal to challenge Medtronic

BTIG analysts estimate that Elutia’s Elupro and Medtronic’s TYRX are competing for a $600 million opportunity in the U.S. cardiac rhythm management sector.

By Nick Paul Taylor • Updated Sept. 11, 2025 -

Medtech VC funding on track to hit highest value since 2021: PitchBook

“Larger rounds increasingly favor top-tier companies and AI-native startups, leaving other startups fighting for a smaller pool of capital,” the firm said.

By Nick Paul Taylor • Sept. 2, 2025 -

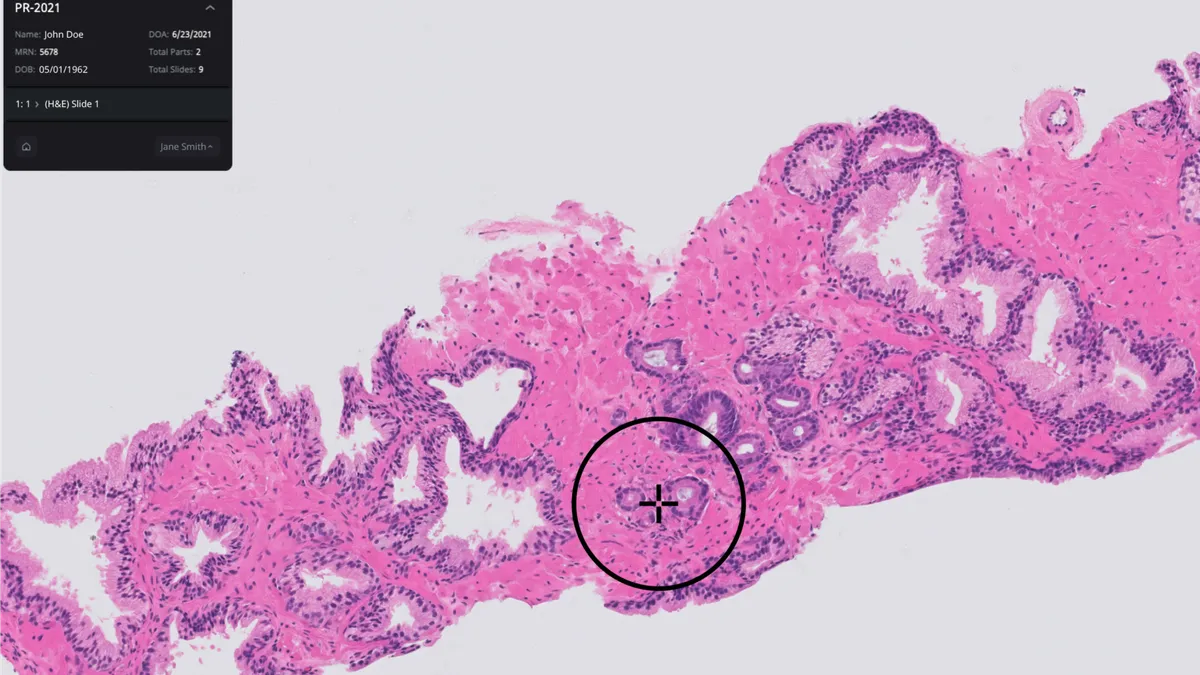

Tempus inks $81M Paige buyout to support AI model development

CEO Eric Lefkofsky said that buying Paige “substantially accelerates” Tempus’ effort to build the largest foundation model in oncology.

By Nick Paul Taylor • Aug. 26, 2025 -

Terumo to buy OrganOx for $1.5B to enter transplant field

OrganOx could capture a greater share of the liver transplant market, where it competes with TransMedics Group, Needham analyst Mike Matson wrote.

By Susan Kelly • Aug. 25, 2025 -

Deep Dive

4 medtech topics to watch for the rest of 2025

From M&A to MDUFA and the developing market in renal denervation, MedTech Dive covers the key issues to watch in the final months of the year.

By Ricky Zipp , Susan Kelly , Elise Reuter • Aug. 25, 2025 -

Masimo appoints several senior execs, resolves cyber incident

The pulse oximeter maker is now fully operational after a spring cyberattack and increased its 2025 profit forecast, but investors have raised questions about the status of a partnership with Philips.

By Susan Kelly • Aug. 8, 2025 -

FTC moves to block Edwards’ JenaValve acquisition

Edwards Lifesciences and JenaValve said they remained committed to completing the deal and would defend the case in court.

By Susan Kelly • Aug. 6, 2025 -

Alcon to acquire STAAR Surgical for about $1.5B

BTIG analyst Ryan Zimmerman called the transaction “a solid deal” for Alcon given STAAR’s struggles in the China market.

By Susan Kelly • Aug. 5, 2025