M&A

-

Labcorp closes takeover of Empire City assets to fuel New York expansion

The company struck three deals in New York last year as part of its push to acquire hospital and regional testing labs.

By Nick Paul Taylor • Feb. 11, 2026 -

Medtronic to acquire CathWorks for up to $585M

The purchase will give Medtronic a larger presence in the cath lab, with a tool to help diagnose and treat coronary artery disease.

By Elise Reuter • Feb. 3, 2026 -

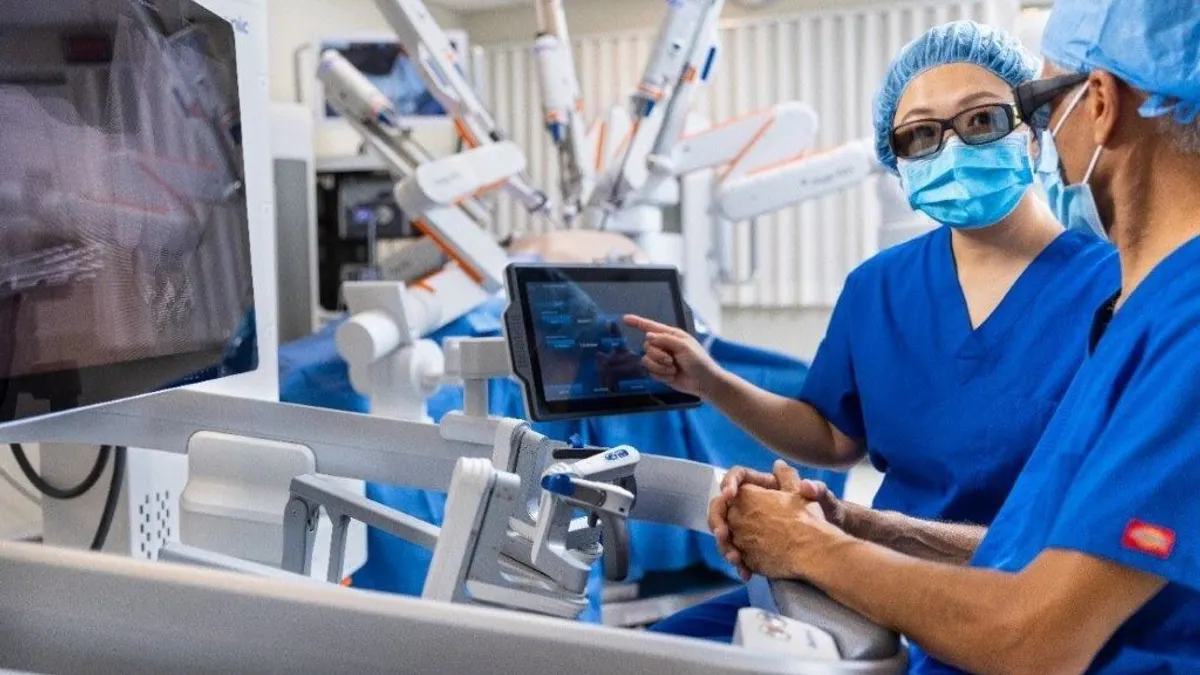

Top medtech trends to watch in 2026

From M&A to surgical robotics and user fee negotiations, the medical device industry has a busy year ahead. Check out MedTech Dive’s roundup of the top medtech trends to watch in 2026.

By Ricky Zipp • Jan. 29, 2026 -

Medtech M&A took off in the second half of 2025: report

Acquisitions and spinoffs in 2025 surpassed the previous three years, according to a report from Bain & Company.

By Elise Reuter • Jan. 28, 2026 -

BD, Waters set completion date for $17.5B biosciences and diagnostics merger

With Waters stockholders voting to issue shares, the companies are targeting a Feb. 9 close date for the deal.

By Nick Paul Taylor • Jan. 28, 2026 -

3 takeaways from Boston Scientific’s $14.5B Penumbra deal

Penumbra is expected to give Boston Scientific more of a presence in the vascular surgery market, with little overlap between the two companies’ products.

By Elise Reuter • Jan. 20, 2026 -

Boston Scientific to acquire Penumbra for $14.5B

With the planned purchase, Boston Scientific will gain several thrombectomy devices to remove clots from blood vessels.

By Elise Reuter • Jan. 15, 2026 -

Digital health funding increases in 2025, spurred by AI: report

Startups raised $14.2 billion last year, the highest funding total since 2022. Health AI companies collected 54% of total funding, according to Rock Health.

By Emily Olsen • Jan. 15, 2026 -

Smith & Nephew to acquire Integrity Orthopaedics for up to $450M

The company has committed the cash, half of which it is paying upfront, to buy Integrity Orthopaedics for its rotator cuff repair system.

By Nick Paul Taylor • Jan. 14, 2026 -

Boston Scientific to buy incontinence device maker Valencia

The deal would set up Boston Scientific to compete with Medtronic in the market for neuromodulation devices that work by stimulating the tibial nerve.

By Susan Kelly • Jan. 12, 2026 -

Edwards calls off JenaValve buyout after court halts deal

Edwards terminated the deal after the Federal Trade Commission moved to block the acquisition due to anticompetitive concerns.

By Susan Kelly • Jan. 12, 2026 -

Haemonetics to acquire Vivasure Medical

The purchase is expected to expand Haemonetics’ impact in fast-growing markets for structural heart and endovascular procedures.

By Elise Reuter • Jan. 9, 2026 -

Deep Dive

4 medtech topics to watch in 2026

From insurance coverage questions to M&A and tariffs, here are the top storylines to watch in the medical device space in 2026.

By Ricky Zipp • Jan. 8, 2026 -

STAAR shareholders reject Alcon’s revised buyout offer

The implantable lens maker said it would remain a stand-alone company after its shareholders turned down Alcon’s $1.6 billion offer.

By Susan Kelly • Jan. 6, 2026 -

Natera acquires Foresight Diagnostics for up to $450M

Foresight’s technology will be integrated into Natera’s Signatera platform and is expected to be launched for clinical use in 2026.

By Susan Kelly • Dec. 10, 2025 -

Teleflex inks deals to sell 3 businesses for $2B

Needham analysts said Teleflex’s inability to secure a price above the low end of their expectations could reflect “the continued poor performance of UroLift.”

By Nick Paul Taylor • Dec. 10, 2025 -

PitchBook: AI tuck-in deals to drive M&A acceleration in 2026

Buyers will focus on “tuck-ins that add AI or data-driven capabilities or can meaningfully improve scale against emerging competitors,” the analysts said.

By Nick Paul Taylor • Dec. 3, 2025 -

GE HealthCare to buy Intelerad for $2.3B

GE HealthCare forecast Intelerad’s revenue to be approximately $270 million in the first full year of ownership. The deal expands GE HealthCare’s presence in more outpatient settings.

By Ricky Zipp • Nov. 21, 2025 -

Solventum inks $725M Acera takeover

The company has stepped up its interest in M&A since making a $4.1 billion divestiture that strengthened its balance sheet.

By Nick Paul Taylor • Nov. 21, 2025 -

Abbott’s $21B Exact Sciences buy reveals future strategy

The proposed deal, the biggest under CEO Robert Ford’s tenure, would allow Abbott to enter a large, new market for cancer testing.

By Elise Reuter • Nov. 21, 2025 -

Abbott to acquire Exact Sciences for about $21B

The purchase would give Abbott access to cancer screening tests including Cologuard and blood tests for multi-cancer early detection.

By Elise Reuter , Susan Kelly • Updated Nov. 20, 2025 -

Labcorp inks deal to buy Parkview Health outreach laboratory assets

The takeover extends a string of deals that have consolidated the outreach lab services market.

By Nick Paul Taylor • Nov. 14, 2025 -

Judge denies FTC’s bid to block $627M Surmodics buyout

The ruling removes a barrier to a deal the FTC claims will eliminate competition in the outsourced hydrophilic coatings market.

By Nick Paul Taylor • Nov. 12, 2025 -

Laborie inks $465M deal to buy post-childbirth device from Organon

Organon tripled sales of the bleeding-control system from 2022 to 2024 and is on track to grow sales again this year.

By Nick Paul Taylor • Nov. 10, 2025 -

Qiagen inks $225M single-cell buyout as CEO prepares to step down

Qiagen has identified Parse Biosciences’ technology as complementary to its sample technology and bioinformatic businesses.

By Nick Paul Taylor • Nov. 5, 2025